Market Is Close To the All-time High – Speedbump On Wed – Move Stops Up

Posted 10:00 AM ET - I have nothing new to add. The news is light. Housing starts were good. Raise your stop to SPY $197. The rest of the comments are the same as they were yesterday.

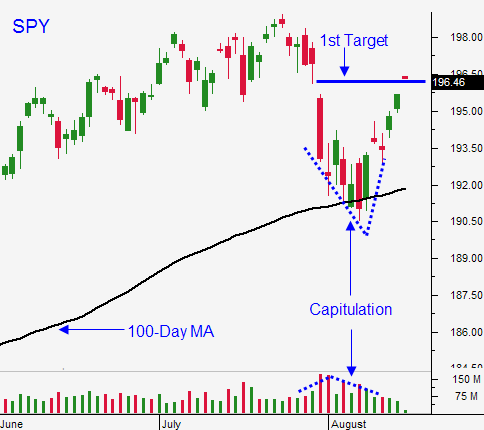

Since testing the 100-day moving average 10 days ago, the market has been strong. Tensions in Russia flared last Friday and we saw a swift pullback. Trading volumes are light and we can expect periods of volatility.

Ukrainian troops continue to win battles and worries of a Russian invasion eased over the weekend. A BBC reporter cited that Russian armored vehicles were crossing the border last Friday. The initial reaction was negative, but apparently, this has been going on for quite a while. The market is discounting the threat of war.

Iraq took back the dam in Mosul and conditions are improving. US airstrikes are helping.

The economic news last week was soft. China's industrial production and retail sales came in slightly below estimates. Japan's GDP (-6.8%) was dismal and so was the EU's GDP (.7%). US retail sales were flat and analysts were looking for a .3% increase.

The economic news this week is light. Flash PMI's will be posted on Thursday. The US and China will be good and the EU will be disappointing. In aggregate, these numbers should be market neutral.

The FOMC minutes will be released Wednesday. I am expecting some dissension among Fed officials. If the market gets ahead of itself this week, we will see a pullback after this release.

On Friday, Janet Yellen will speak in Jackson Hole. We can expect dovish comments and the market will recoup any ground that was lost from the FOMC minutes.

In my comments last week I told you that my stops had all been raised. I exited my call positions when the SPY breached $196. I locked-in profits and I enjoyed my weekend. I am not overly concerned that I missed the move this morning. From my standpoint, conditions in the Ukraine have the potential to deteriorate rapidly and the market is not pricing in a conflict. We could have easily been down 20 points on the open today if the troop movements had increased.

I will wait patiently on the sidelines and I believe I will have an opportunity to get back in after the FOMC minutes.

The market is within striking distance of the all-time high and resistance will build. As we get closer to the September FOMC meeting (16th), interest rates will start to creep higher. I don't believe that Asset Managers feel like they will miss the next big rally.

If you are long calls, raise your stop to SPY $196.50. Keep moving your stop up as the market rallies.

DC is in recess, earnings season is almost over, the economic news is light and traders will take time off before their kids head back to school. Light trading volumes and an upcoming holiday favor the five-year bull market.

If I get back in, I will keep my size small (10% of my normal trade allocation).

Look for a grind higher today, a speed bump on Wednesday and a recovery on Friday.

.

.

Daily Bulletin Continues...