FOMC Minutes Could Spark a Light Round of Selling – Take Profits Before 2:00 PM ET

I often wonder if the hours I spend on my market comments are wasted. Please help me decide if I should continue or stop.

My goal is to evaluate upcoming events and to forecast the market reaction. I disclose my rationale, my trades and my trade allocation and my stops. I do not regurgitate information from Yahoo Finance.

I don't advertise on my blog and all of the information is completely free. My reward is your comments on Investimonials.

I urge you to respond to the last post on INVESTIMONIALS. Be honest and add a comment right to the post. If you think I am full of crap, say so or don't post anything. Both actions will serve the same purpose. If you have benefited from my research, say so.

Here is my comment about hedge funds. Like newsletters - some are good - some are not. My comment about the subscription fee going to $5000 was on an annual basis. For a $500K account, that is 1%. Hedge funds on the other hand charge 2% and they have a 20% incentive fee - yet the writer claims my fees are outrageous. To learn more about my system, attend tonight's webinar and judge for yourself.

If you want to watch the webinar in question CLICK HERE.

If you want to attend tonight's webinar CLICK HERE.

Again, please CLICK HERE to post a comment on Investimonials and be honest. Now for today's information.

Posted 11:30 AM ET

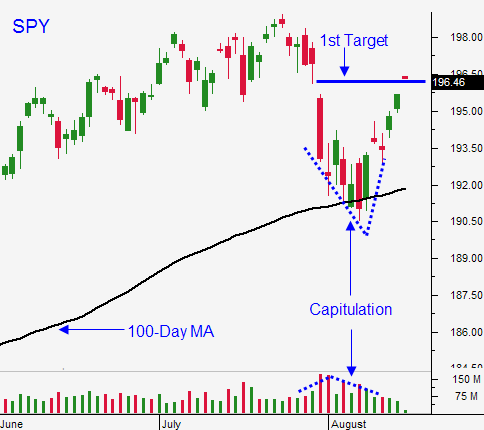

The market tested the 100-day moving average two weeks ago. Bullish speculators were flushed out and support was established. Since then, the market has been grinding higher and the SPY is challenging the all-time high. Tech stocks are strong and the QQQ has broken out to a multi-year high.

Conditions in the Ukraine and in Iraq are improving. Geopolitical conflicts have recently weighed on the market and those worries have temporarily subsided.

This afternoon, the FOMC minutes will be released. Strong domestic economic activity will force some voting members to favor tightening before May 15, 2015. This will be revealed in the minutes and I believe the market will have a negative reaction. If you are long calls, I suggest taking profits before 2:00 PM ET.

Tomorrow, flash PMI's will be released. Solid performance in China and the US will offset weakness in the EU. Overall, the news should be market neutral.

Friday, Janet Yellen will speak in Jackson Hole. Her comments are typically dovish and they should calm bond vigilantes. The Fed will not meet until September 16th and she will not introduce alternative tightening measures when they are in recess. Any pullback that we get from the FOMC minutes should be reversed on Friday.

I took profits on my call positions last Friday and I have been on the sidelines during the last leg of this rally. If we get a pullback, I will buy calls once support is established. I will keep my size small (10% of my normal trade allocation). I don't want to risk recent profits in this light volume environment.

The price action should be bullish next week as a major holiday approaches.

Interest rate worries will start to mount as we get closer to the October FOMC meeting. The Fed's bond purchase program will end and the focus will immediately shift to tightening.

.

.

Daily Bulletin Continues...