Negative News and the SPY Is Breaking Out To A New All-time High On Light Volume

Thank you to those of you who posted comments on INVESTIMONIALS. They are my only motivation.

I will be redesigning my blog this fall and when the new site is launched I will stop posting my daily market comments. I will replace them with other worthwhile research that I can automate. Until then, I will keep posting. If you have suggestions - {encode="[email protected]" title="CLICK HERE"} and send me an email.

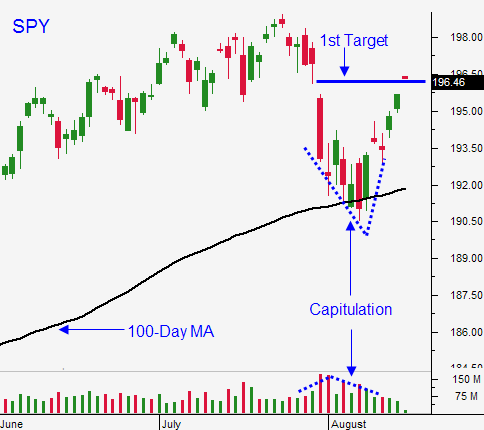

Today, the SPY is making a new all-time high. Tech stocks have been strong and QQQ made a new multi-year high last week. The news is light and there is nothing to stand in the way of this rally.

Yesterday, the FOMC minutes were hawkish in my opinion. Some Fed Officials are prepared to raise rates if economic conditions continue to strengthen. That moves the May 2015 timeline forward. The market pulled back briefly on the news and it recovered quickly.

Janet Yellen will speak In Jackson Hole tomorrow. Many traders are expecting dovish rhetoric and good news is priced in. This could be a sell the news event. If Janet Yellen hints of tightening, sellers will pounce on the market.

Flash PMI's were a bit disappointing this morning. Europe was soft and that was expected. However, China's numbers also came in light. Japan was strong, but it is rebounding after a 6.9% decline in GDP last quarter. This news did not dampen spirits this morning and stocks continue to push higher.

I am day trading from the long side, but I'm not taking overnight positions. The market should grind higher today.

Yesterday I suggested exiting call positions. The market is at an all-time high and the gains have come on light volume. That means it is vulnerable. One negative news event out of the Ukraine could send the S&P futures tumbling just as it did a week ago.

If you are anxious to buy calls, wait until Janet Yellen delivers her speech (Friday - 10 AM Eastern). We need to see the market reaction. If it is negative, keep your powder dry heading into the weekend. If the reaction is neutral to slightly positive, take a small call position (10% of your normal trade allocation).

The economic news next week is very light (durable goods and GDP). A major holiday should keep a bid under the market and stocks should inch higher.

As good as this breakout feels, the September 16th FOMC meeting is right around the corner. As soon as tapering ends, the focus will shift to tightening.

I don't feel like I'm going to miss the next big rally so I am playing it safe.

.

.

Daily Bulletin Continues...