Janet Yellen Will Speak – Sell the News – Market Ripe For A Small Round Of Profit Taking

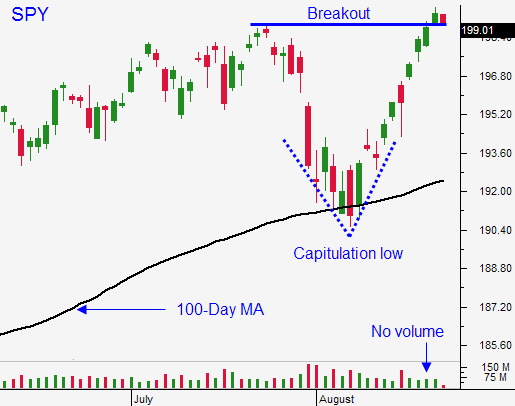

Posted 9:45 AM ET - The market is melting up on light volume. Tech stocks have been particularly strong and the QQQ made a new multi-year high last week. Yesterday, the SPY made a new all-time high. Good news is priced in and any hint of tightening from Janet Yellen this morning will spark profit-taking.

The Fed Chairman will speak in Jackson Hole at 10 AM ET. Traders are expecting dovish comments and that is why the market rallied yesterday. This could be a sell the news event.

The FOMC minutes on Wednesday revealed that many Fed Officials are leaning towards tightening sooner than the May 2015 timeline if the economy continues to grow at its current pace. Surprisingly, the market ignored the hawkish news. Yesterday after the close, the Fed's Plosser made hawkish statements.

The next FOMC meeting is a few weeks away. Interest rates will start to creep higher and when tapering ends in October, the focus will immediately shift to tightening.

Tensions in the Ukraine are building. Russia's humanitarian convoy pushed through checkpoints without approval. Battles are intensifying and the market has completely discounted this conflict.

Flash PMI's were soft this week. Traders expected dismal news from Europe, but China also came in light. The economic releases next week (durable goods and GDP) should not have much of a market impact.

One item that has not received much press is Obamacare. I've a number of HMO analysts say that insurance premiums will rise 15 to 20%. Those notifications will go out shortly. Businesses will ask workers to contribute more and self-employed business owners will have to bite the bullet. Deductibles are high and premiums could go up more than $3000 next year depending on the plan. This would take a huge bite out of discretionary spending.

The market has been oblivious to all the bad news and I believe we could see a normal correction in September.

I am not going to buy calls today. In fact, I want to buy a few puts. If Janet Yellen's comments spark a rally and it stalls quickly, I will buy puts. My allocation will be tiny (5% of normal). If the market declines on the news, I will buy puts below SPY $199. The key is to wait for the reaction – don’t jump in before she speaks.

The market rally is over-extended and I am simply looking for a small pullback. All it will take is one small news item to spark profit-taking.

From a longer-term perspective, I will get more bearish with each passing week. I need to see technical evidence that the internals are deteriorating before I get short.

DC is in recess, earnings season is over, economic releases are light and traders are taking time off before their kids go back to school. Volumes are extremely low and this is a good time to stay on the sidelines.

.

.

Daily Bulletin Continues...