Very Qiet Week Ahead – Look For Dull Trading With A Slight Upward Bias

Posted 10:20 AM ET - The news this weekend was very light. Russian convoys left the Ukraine and the ECB plans to ease. Global markets are trading higher and the S&P 500 is making a new all-time high.

The conflict in the Ukraine seems to be settling down. Most analysts believe that Putin does not want to start a war and the market has completely discounted the chance of this happening.

Mario Draghi said that the ECB might start quantitative easing in September when he spoke in Jackson Hole. He cited structural economic issues. Economic sanctions against Russia could also weigh on EU activity.

Janet Yellen's speech on Friday barely impacted the market. We know from the Fed minutes that a growing number of officials favor tightening before the May 2015 timeline if economic activity continues to grow at its current pace. Durable goods orders will be released Tuesday and GDP will be released on Thursday. Both numbers should be market neutral.

Earnings season has ended and the results were good. Profits were up 8% and revenues were up 5%.

Interest rates remain at historic lows. Bond Managers are not worried about higher yields even though the focus will quickly shift to tightening after tapering ends in October.

DC is in recess and "no news is good news".

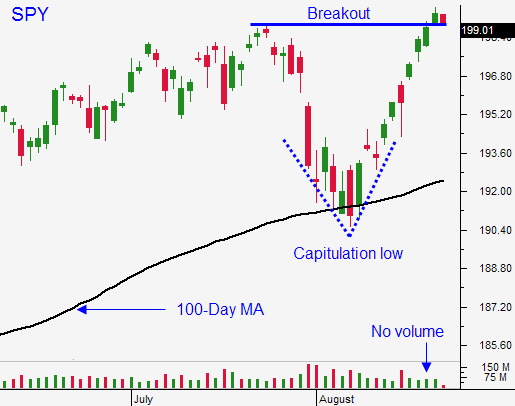

A quiet, light volume trading environment favors the five-year bull market. Stocks typically trade higher into major holidays and the bias will be positive this week.

I am day trading and I might take some time off myself. The price action seems a little frothy and one piece of bad news could spark a quick decline.

I took a tiny put position last Friday (5% allocation). If the rally today holds up today, I will exit.

If you are long calls, use SPY $199 as your stop.

Look for a very dull market this week with a slight upward bias.

.

.

Daily Bulletin Continues...