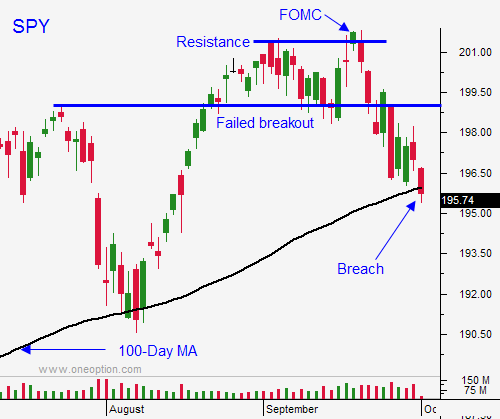

The 100-Day MA Is Within Striking Distance – We Will Test It Today

Posted 9:50 AM ET - Five-year bull markets die hard and the market has been able to shoulder a fair amount of bad news in the last few weeks. Gradually, profit takers are chipping away at the bid and we should see a decline that tests the 100-day moving average.

Yesterday, I recorded a video on credit spreading. I used my system to review signals on individual stocks.

CLICK HERE to view it

Please post comments on You Tube and take a few seconds to like/unlike. I will respond to some of your comments.

Protests in Hong Kong continue to fester. China is celebrating a holiday this week and crowds could grow.

The ECB will announce its QE tomorrow. Many analysts believe that the statement will be short on details. Rumor has it that they are considering a €200 billion program. That is shy of expectations and it would weigh on the market.

ADP came in at 213,000. That was a little better-than-expected and it bodes well for Friday's jobs report. If the unemployment rate falls below 6%, the Fed's tightening target will be met. Bond vigilantes could get nervous and interest rates could creep higher.

Overnight, we learned that the first case of Ebola has been discovered in the US. This will spook investors. Travel and leisure groups will be hit the hardest. As long as we don't have any new cases, this won't be a problem. If it spreads, economic activity will contract.

Bullish sentiment was very high a few weeks ago. Call buyers are hanging on by their fingernails and I believe they will get flushed out today.

ISM manufacturing will be released 30 min. after the open and the number should be strong. We are in a phase where good news is bad news.

The selling pressure this morning is heavy. If we make a new low after an hour of trading, we could hit the 100-day moving average today. I will day trade from the short side.

We want a breach of SPY $195. Buyers will eventually step in and we will rally back above the 100-day moving average. We don't want to trade this first bounce. I will sell some out of the money put credit spreads to distance myself from the action. The market will challenge that support a second time and when it holds, buy calls.

This scenario might take a few weeks to play out. Once earnings season begins and we are past the FOMC meeting, stocks should rally.

If you are a nimble, trade from the short side. Use stops and set your targets at the 100-day moving average.

If you are a swing trader, wait patiently for support. An excellent buying opportunity will set up in the middle of October.

.

.

Daily Bulletin Continues...