Market Rebound Is Under Way – We Should See Follow Through Buying Today

Posted 9:40 AM ET - Last night I recorded my webinar and it contains lots of new trades.

CLICK HERE TO WATCH IT

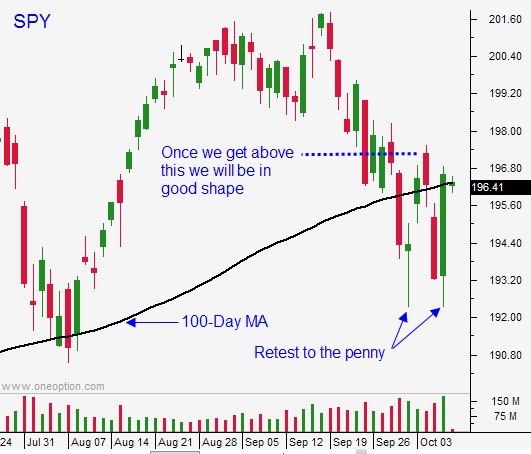

Yesterday, I mentioned that the market would probe for support early in the day and that we would test the low from last Thursday ($192.40). To the penny, that's exactly what happened. As the morning unfolded, buyers emerged. We had a nice steady rally into the FOMC minutes and the second bounce was underway.

In my comments I mentioned that the word "disinflation" could creep into the Fed minutes. Officials are concerned and this will keep the Fed from tightening. Japan has been fighting deflation for a decade and the BOJ has been printing money like mad to spark an uptick. The Fed has learned from their mistake and they will tighten until the threat is gone.

The FOMC meeting is on October 29th and I believe they will leave the phrase "considerable time" in the statement. They want to terminate the bond purchase program first.

This morning we will get a dose of "Fed Speak". Some hawks are on the docket, but I don't believe they will spoil this bounce.

Even with all of the strong economic releases, interest rates have fallen. Global worries have prompted a flight to quality.

Alcoa kicked off earnings season and the results were good. GE will post Friday morning and banks will release next Tuesday. I am expecting good news from the financial sector and it will set the tone.

Economic activity in Germany is slowing. It is the largest economy in the EU so this is significant. Industrial production fell 4% and that sparked a wave of selling on Tuesday. This morning we learned that Germany's trade numbers fell to a five-year low. This could prompt fiscal spending.

IDC reported that PC sales declined by 1.7%. That is better than the 4% drop that was projected. The XP upgrade cycle has run its course. Overall, this news was good for the tech sector.

Ebola is a potential concern. If other countries around the start reporting cases panic could set in. It is not airborne so it spreads slowly. From a trading standpoint, it is not an immediate concern. I will monitor the outbreaks and pray that it can be contained.

As Europe contracts, credit issues could be a concern in 2015.

For now, strong profits will overpower weakness in Germany. We should see a nice bounce that lasts a week or more. The initial gains will come very quickly and you want to be long NOW.

The market will probe for support early this morning. We want the damage to be contained. Asset Managers will buy stocks ahead of earnings season and they don't want to miss a year-end rally. At this price level they should be fairly aggressive. Stocks should rebound and grind higher. If we close in positive territory today, the bounce will be underway.

In my trading platform I posted updates throughout the day. Once we tested the lows from last Thursday, I started buying. I told subscribers that I would get all the way back in if the reaction to the FOMC minutes was positive. The small loss I took Tuesday has been wiped out and I have nice profits. I will protect them and I will use SPY $195 as my stop. If the market grinds higher this morning I will add.

If you want market updates during crazy markets, consider a platform subscription.

Buy calls and use stops. Once we get a decent rally, we can move our stop up to the 100-day moving average.

.

.

Daily Bulletin Continues...