Ebola Leads to Panic Selling – Option Expiration and Margin Calls Will Add To the Decline

Posted 10:00 AM ET - Yesterday, the market made a new intraday high and it look like we might bounce. I day traded from the long side and made some money on a few scalps. I expected to see a gradual grind higher after decent earnings from banks and J&J. As the day wore on, the bid weakened. Once we fell below SPY $189 I stopped day trading. That was not the price action we wanted to see.

Overnight, a second Ebola case was reported in Texas. This is all the market needed to hear. The S&P 500 was down 12 points an hour before the open. Retail sales (ex-autos) were down .2%. This is much worse than expected and the futures dropped another five points.

I am writing my comments just before the opening bell and the S&P is down 28 points. The selling this morning will accelerate. Ebola was the catalyst, but option expiration and margin calls will play a role. Premium sellers will be scrambling to adjust (sell futures or buy back puts). Anyone who sold October put premium will be paying dearly to buy them back. Hedge funds will also be liquidating. US treasuries are screaming higher and oil is tanking.

This adjustment will push the futures down and we could hit a massive air pocket (S&P down 50 points). The price action will be scary, but it will appear to be much worse than it actually is.

I barely stuck my toe in the water when I sold out of the money put credit spreads in the retail sector last week. Based on this morning's dismal consumer spending, I will reel those positions back in.

Earnings season has been good. Intel posted solid results and PC sales helped. Alcoa was strong last week and banks were good yesterday. Unfortunately, earnings won't attract buyers with the dark Ebola cloud hanging over us.

In a poll yesterday, CNBC said that 47% of respondents were worried about Ebola and 24% were worried about economic conditions in Europe. I'm sure that Ebola fears will be even higher today.

I've been advising you to take partial profits on your put positions. Now that you've gone to the bank, you can ride your remaining positions without being nervous. We are below Monday's close and I would use that as your stop.

This will ultimately set up an excellent buying opportunity. However, we are not going to stick our head in that noose. Ebola will get worse before it gets better.

I will day trade the S&P futures today. The liquidity is fantastic and I don't have to worry about option implied volatilities. I will be trading both sides since I believe there will be many whipsaws.

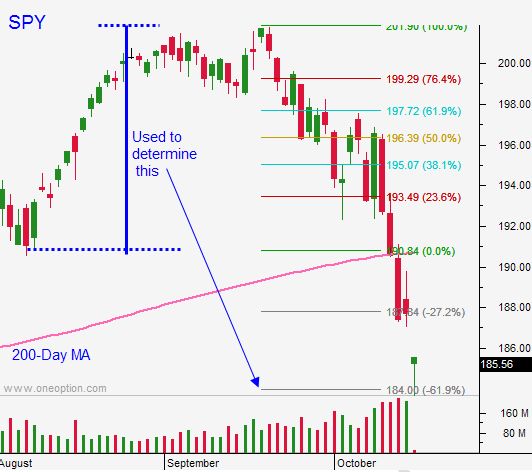

My target for the SPY was $184 and it looks like we will hit it today. That was a Fibonacci extension, but no one is paying attention to technical or fundamentals. Panic selling and position adjustments could result in an air pocket.

All of the 1OSystems have been bearish and subscribers are making a killing. Get on board.

.

.

Daily Bulletin Continues...