Market Will Test the All-time High This Morning – Surprise Move By the BOJ

Posted 9:00 AM ET - I have to show you what our system has done trading SPY, QQQ, GLD and TLT. It was great yesterday and it is even better today.

CLICK HERE TO WATCH THE VIDEO

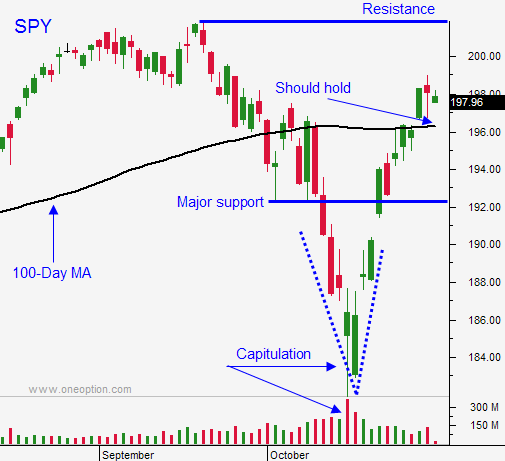

Yesterday the S&P continued to climb and this morning we are challenging the all-time high. Did we just have a 10% correction or am I dreaming?

In a surprise move, the Bank of Japan eased. Only 2 out of 13 economists polled expected the move. The BOJ was split and this was a bold decision.

It is Halloween and shorts are going to get spooked this morning. The S&P 500 is up 20 points before the open and the first wave of buying will be short covering. Once this adjustment settles down, it will be interesting to see if profit-taking keeps a lid on the rally.

On the surface, this looks extremely bullish. From my perspective, this was an act of desperation on the part of the BOJ. Europe is also slipping and the ECB is out of bullets.

On the positive side of the ledger, the Fed kept "considerable time" in its statement, GDP was better than expected, oil prices are falling (good for consumers), the GOP should win elections on Tuesday, the Fed expects strong employment, earnings have been solid, corporations are buying back stock at a record pace, interest rates are near historic lows, and we have seasonal strength working in our favor.

I believe the good outweighs the bad. On a short-term basis, I will play this in either direction. On a longer-term basis, I would like to buy any pullback.

After the first hour of trading, I will trade the range. If we are above the high, I will buy. If we are below the low, I will short.

I will also take profits on some of my put credit spreads. They are in great shape and the premium will be drained this morning. I can't make much more on these trades so I will release the margin.

If you are long calls, lock in some of your profits. Going to the bank always feels good and it will make the rest of your position easier to manage.

At this stage, good news is baked into the market. I was looking for a rally on strong employment numbers next week, but the price action the last two days has already factored that in.

This morning, we will be able to gauge profit-taking. If we back off quickly, it will indicate that resistance is still strong. If the market is able to grind higher all day, it will be a sign that under-allocated Asset Managers are playing catch-up and that we still have room to run.

Watch for these "tells" today and trade accordingly.

.

.

Daily Bulletin Continues...