Any Dip Will Be Brief and Shallow – Table Is Set For A Year-End Rally

Posted 9:45 AM ET - I have to show you what our system has done trading SPY, QQQ, GLD and TLT

CLICK HERE TO WATCH THE VIDEO

Good news was built into the FOMC statement. The market staged a massive rebound from its lows two weeks ago and the bounce was a little over-extended. We saw some profit-taking into the Fed's statement, but the damage was relatively contained.

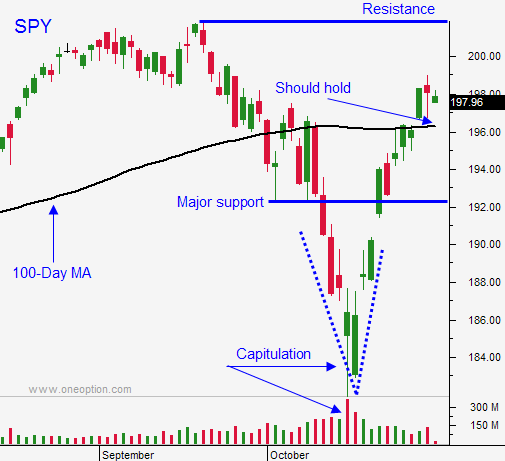

The SPY was $.50 away from touching the 100-day moving average and buyers stepped in before it was tested. I sense a strong bid and any dip will be shallow and brief.

The Fed ended its bond purchase program and it kept the phrase "considerable time" in its statement. It will not meet until December and that is bullish for the market. They cited strong job growth and the numbers next week should be excellent.

Consumer confidence hit a multi-year high and gasoline prices are falling. This should bode well for holiday shopping.

Europe will probably go through a recession, but we have been dealing with economic weakness in the EU for years. European companies are starting to report earnings and that could weigh on their markets.

Growth in China is stable at 7.5%. Their flash PMI's, GDP, IP and retail sales were better-than-expected a week ago.

Economic conditions in the US are healthy. Q3 GDP was released this morning and it came in at 3.5%. That was better than expected and it is a strong number.

Earnings season has been good apart from tech stocks that have high P/E’s. Corporations are buying back stock at a record pace and that will keep a bid under the market.

Interest rates are near historic lows and equities are attractive on a relative basis.

Analysts believe that Republicans will win the Senate next week. A GOP victory might be goosing the market, but it won't have much of an impact. We are still going to see gridlock.

I read the best news of the week this morning. Healthcare officials in Liberia stated that the number of new Ebola cases is decreasing. We are not out of the woods yet, but let's pray this trend continues.

Seasonal strength will attract buyers and the table is set for a year-end rally.

For now, I will ride my put credit spreads. I have plenty of cushion and I will let time decay work its magic.

I will NOT be trading the S&P's based on the one hour range. This tactic works well when we have market momentum. The freefall and snapback rally have run their course and I believe the market will consolidate. That means the intraday price action will be choppy.

I don't want to buy calls at this level. We could chop around until next Tuesday and I don't want to be exposed to time decay. If we get a nice dip to the 100-day moving average, I will buy calls. The bid seems relatively strong and I doubt we will get that low. By the same token, I sense that there is some profit-taking at this level so we won't see a breakout this week.

If you are long calls in individual stocks that still have good momentum, stick with the trade. Also look for stocks that are breaking out through horizontal resistance. Those will typically have follow-through buying for a few days.

I believe the market will regain its footing next week and we are likely to challenge the all-time high in November.

.

.

Daily Bulletin Continues...