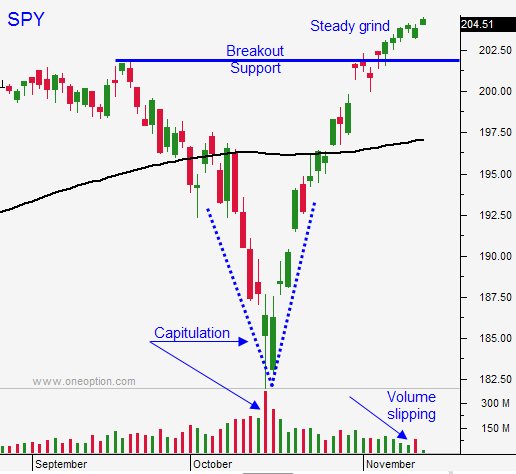

Light News and Seasonal Strength Favors The Bulls – Market Will Grind Higher Next Week

Posted 9:45 AM ET - The SPY has struggled to advance the last two days, but I'm not concerned. The market has come a long way in a short period of time and it needs to gather strength. The DIA and QQQ were able to advance yesterday.

China's numbers (industrial production and retail sales) were good yesterday and there are rumblings that the PBOC might inject short-term liquidity.

This morning, EU GDP's were released and they were better than feared. Germany's growth came in at .1% and it is not falling off of a cliff.

Domestic economic releases have been strong. This morning, retail sales came in better than expected (.3%). Lower gasoline prices and holiday optimism will keep a bid under this sector.

Retailers have been reporting light revenues and decent profits. The guidance has been poor, but the stocks have been rallying after posting results. Earnings releases will be dominated by retailers next week.

The news is light the next few days and that favors seasonal strength. Wednesday, the FOMC minutes will be released. In a light news environment, it will be the focal point. There is some Fed Speak this morning, but I don't believe the news will have a material impact on the market. The Fed sees strong employment and the potential for disinflation. This should keep them accommodative until June.

Flash PMI's will be released next Thursday. Strength in the US and China will offset weakness in the EU.

The macro backdrop is bullish and the market will continue to grind higher. I am not looking for an explosive move, just a steady grind. Consequently, I am long in the money December call options that have a high delta. This will keep my exposure to time decay at a minimum and these options will move point for point with the underlying (I can take profits along the way).

I am also short out of the money put credit spreads in November. I will start rolling those into December today. This strategy allows me to keep my distance and it takes advantage of time decay.

The daily ranges have been tight and the market momentum has stalled. I am not day trading S&P futures because the price action is light and choppy.

I still believe that under-invested Asset Managers are scrambling to get in and they don't want to miss a year-end rally. Seasonal strength will keep profit-taking to a minimum and dips will be brief and shallow. As long as the market grinds higher (no spikes), I don't expect to see any major pullbacks.

Daily volumes are declining. Look for quiet trading with a bullish bias.

I am raising my stop to SPY $203 on a closing basis.

.

.

Daily Bulletin Continues...