Eat All You Want – But Don’t Be A Pig When It Comes To Your Trades – Take Profits

Posted 9:40 AM ET - In addition to full access to my trading system, my highest level subscribers also get a trade video each week

WATCH LAST WEEK'S VIDEO

WATCH YESTERDAY'S VIDEO

CLICK HERE TO SUBSCRIBE

This morning, Q3 GDP came in at 3.9%. That was much better than expected and consumption rose sharply. This bodes well for retailers. Tomorrow, durable goods orders will be released and the number should not have a major market impact.

The riots in Ferguson have not weighed on the S&P this morning.

Stocks are trying to grind higher, but we are still below Friday's open. I sold one third of my call position on that spike and I'm glad I did. As long as the SPY can close above $207 today, I will hang onto my remaining calls (20% of my maximum position). If the market is stable, I plan to sell half of them tomorrow and the other half on Friday.

The market tends to rally into Black Friday and selling off on Cyber Monday. I sold a few out of the money call credit spreads yesterday and I bought a few puts. I am trading against the trend, but I feel good about these positions. The stocks have been weak relative to the market the last few days and after big runs, they are starting to roll over. These are small trades and they will hedge my remaining longs.

I feel that the market is over-extended and at best, it will tread water. Good news is priced in and bullish speculators are ripe to get flushed out.

I'm not looking for a big selloff, just a dip that lasts a couple of days.

This has been an excellent year and the last two months have been fantastic. For all intents and purposes, I could close the books now and be very happy. I have to wonder if other traders feel the same way.

Consequently, I'm not going to be overly aggressive. I've caught the entire rally the last few weeks and I've been able to ride this wave longer than I expected.

Set targets on your long positions and take profits. I suggest getting out of your long positions before the weekend.

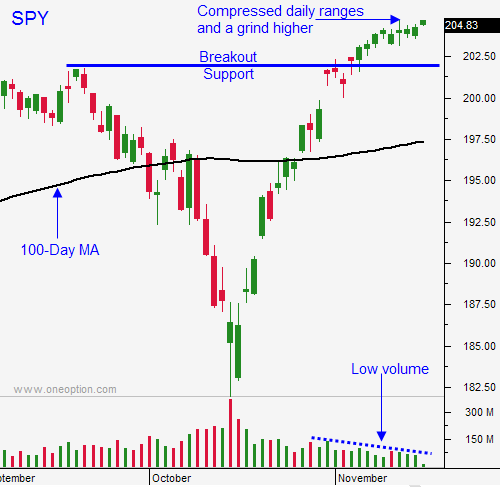

Look for a compressed range after the first hour of trading. Volumes will drop off dramatically.

Use SPY $207 as a stop on a closing basis.

.

.

Daily Bulletin Continues...