Market Will Trade In A Tight Range – It Was Not Able to Breakout on Strong Jobs

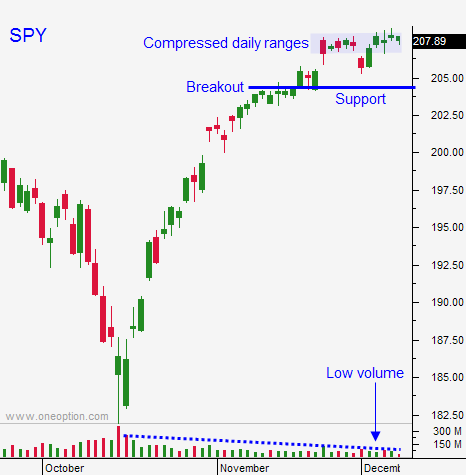

Posted 9:50 AM ET - Last week, the market got an excellent round of economic news and it was not able to breakout to a new all-time high. I mentioned in my comments on Friday that we are likely to fall into a tight trading range this week.

The price action this morning is weak and a few news items are weighing on stocks. Japan's GDP was revised to -1.9% from -1.6%. Many analysts were expecting it to be revised up to 0% and this is bearish news. China's commodity imports showed a 25% decline month over month. Germany's industrial production came in at .2% when .4% was expected. Italy's debt was downgraded by Standard & Poor's. These are all relatively minor events, but collectively they are sparking a little profit-taking.

Domestic economic conditions are excellent. The jobs report last Friday (321,000 new jobs) was the strongest in years. ISM manufacturing and ISM services came in much better than expected.

The Fed will meet on December 17th. They will remain accommodative because global economic conditions are fragile. However, I believe they might remove the phrase "considerable time" so that they have greater flexibility in the future.

The US will hit the debt ceiling right around the FOMC meeting and I believe Republicans will extend it. They want to stay out of the headlines and they control the House and the Senate. This event will be bullish for the market.

As long as China's economy can tread water for a few weeks, we should see a year-end rally. I believe the market has 2% to 3% of upside. China will release industrial production and retail sales on Friday. This will be an important release in an otherwise quiet week.

Buyers and sellers are in balance. Small dips attract buyers and the all-time high attracts profit takers. I don't see any catalysts this week.

Focus on individual stocks that are breaking out through horizontal resistance. This pattern typically lasts 3 to 4 days. Buy deep in the money call options that trade near parity to avoid time decay. If you do not get follow-through, exit the trade.

I am short out of the money put credit spreads from weeks ago and those positions have yielded as much profit as they can. I will be buying them back this week to release margin and to lock in profits. I won't sell any out of the money put credit spreads unless we get a nice will pullback.

I am also long deep in the money calls on stocks that are breaking out. I stay in until the momentum stalls. My risk exposure is very small (10% of my maximum size).

Look for quiet week with tight trading ranges. We might be able to creep above the all-time high.

.

.

Daily Bulletin Continues...