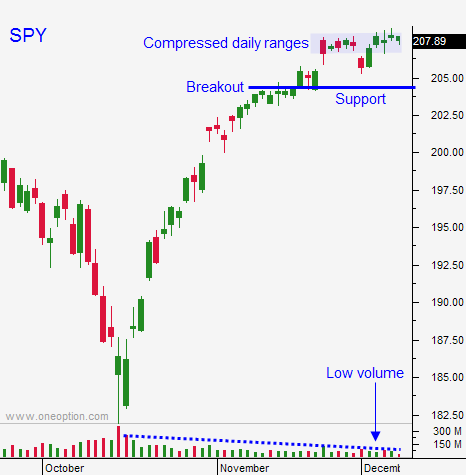

Market Is Testing the Breakout – Bullish Specs Are Getting Flushed Out – Wait For Support

Posted 10:15 AM ET - Yesterday, profit-taking set in after a round of weak news. Once the momentum was established, the selling accelerated. The overnight news raised new concerns and we are seeing follow-through this morning. Bullish speculators are getting flushed out and the breakout at SPY $204 is being tested.

I'm not at all surprised by the move; I thought we were going to see this selling pressure last week. My risk exposure is very small and yesterday I started getting stopped out of my call positions when the stocks fell below their horizontal breakout. This morning, I am getting stopped out of the rest of my call positions. I am keeping these stocks on my watchlist because they are strong relative to the market. My call position was very small (5% of max) so the damage was minimal.

Yesterday we learned that Japan's GDP was revised lower (-1.9% versus -1.6%). This was unexpected since most analysts were expecting an upward revision to 0%. China's commodity imports fell 25% month over month and Germany's factory orders were worse than expected.

This morning, we learned that Chinese regulators are not going to allow investors to pledge low grade corporate debt to secure loans. Their market has been screaming higher and they were due for a pullback. From peak to trough, Chinese stocks were down 8% overnight.

Greece is back in the news. They are scrambling to elect a new President and they might not honor current fiscal restraints.

The Wall Street Journal mentioned that the phrase "considerable time" might be removed from next week's FOMC statement. Didn't I mention this last week?

The debt ceiling will be hit this week. Republicans want to stay out of the headlines and I believe it will get extended. This will be a bullish catalyst.

If I've learned one thing in the last 25 years, don't short the market in December!

Credit concerns could become an issue in 2015, but they won't be a factor in the next few weeks. Central banks are printing money like mad.

US economic conditions are strong, the Fed will remain accommodative, corporate profits are excellent, share buybacks are at a record levels and interest rates are near historic lows. These are all bullish influences and seasonal strength will attract buyers.

I mentioned yesterday that I will stay passive unless we test support at SPY $204. Today I am getting my wish. This does not mean that I am rushing in to buy. I want to see bona fide support first.

If the $204 support level holds, I will sell out of the money January put credit spreads on strong stocks. I will make sure that technical support lies between the short strike price and the stock price. If that support is breached, I will buy back my put spread.

I will also monitor stocks that are in a strong uptrend and have recently broken out. If they pull back to the breakout and that support holds, I will buy calls when the market regains its footing. Healthcare and financials have been particularly strong.

If by chance, support at SPY $204 fails, we could see a nasty decline. I will day trade S&P futures from the short side, but I will not take overnight short positions.

I am only interested in getting long once this wave of selling passes.

Stay on the sidelines and wait for support. Once we bounce, buy the dip.

Do not buy puts or take overnight short positions!

.

.

Daily Bulletin Continues...