Market Will Probe For Support Early – It Should Finish In the Green – Sell Put Spreads

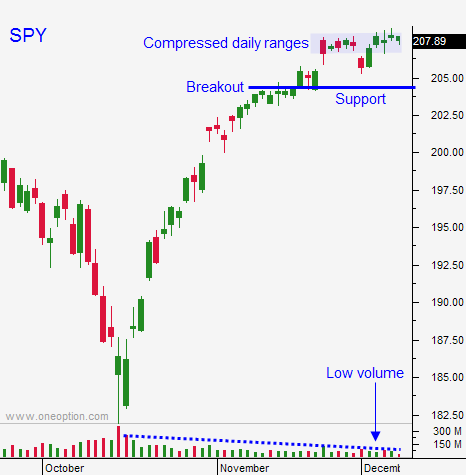

Posted 9:45 AM ET - Yesterday, the market sold off on a weak round of news and bullish speculators were flushed out. The SPY tested the breakout at $204 and that technical support level attracted buyers. By the end of the day, stocks recovered from a 24 point S&P decline.

We have caught every major move this year and now we are in a light volume, low probability trading environment. I can't stress this enough - keep your size small. I don't trade wiggles and jiggles because I can't predict them.

Once the market tested support it bounced and it did not look back. I sent an update to subscribers letting them know that I was selling out of the money January put credit spreads. Seasonal strength will keep a bid to this market and this strategy allows me to keep my distance. Time decay will whittle away at my spreads through year-end and I won’t have to worry about these overnight moves.

I was shaken out of my call positions and I might re-enter if they rally back above the breakout. I am keeping my size very small.

In my comments yesterday I warned you not to buy puts. It is foolish to trade from the short side during the month of December.

I am not overly concerned with Greece, soft economic conditions in Japan and Europe, the debt ceiling, or low oil prices. Europe's economic conditions will be stable through year-end and most analysts are expecting a small rebound in Japan. The debt ceiling will be extended and low oil prices will boost global consumption.

China will post retail sales and industrial production Friday morning. This news has me a little nervous. If the numbers are in line, we will have a nice year-end rally the challenges the high. If the numbers are weak, we could see more profit taking. China lowered its GDP estimate for 2015 this week to 7%.

We could see a little nervousness into the FOMC meeting next week. The phrase "considerable time" should be removed, but the Fed will remain accommodative.

When the market failed to rally on a strong employment number last Friday, I suspected that we were headed for a tight trading range. The news is light and trading volumes are declining.

Distance yourself from the action and sell out of the money put credit spreads in January. Focus on stocks that are in a strong uptrend and that held up well yesterday. Make sure there is technical support between the stock price and the short strike price. If that support level is breached, buy back the spread.

I believe the market will probe for support early this morning. The damage will be contained and we should finish in positive territory.

.

.

Daily Bulletin Continues...