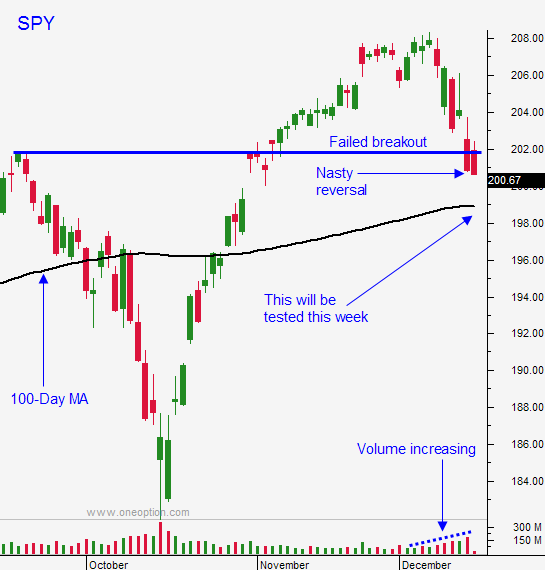

Market Will Test the 100-Day MA This Week = Early Bounce Did Not Hold

Posted 10:50 AM ET - Last week, the market broke major horizontal support at SPY $202. That was a technical breakout from October and speculators who got long at that level were flushed out Friday. The selling pressure was heavy and we closed on the low of the day.

This morning, the S&P 500 has been up 20 points. This bounce will help me gauge the strength of the bid. If stocks are able to grind higher throughout the day we might have seen a temporary low. I still feel that the FOMC statement on Wednesday will weigh on the market, but Friday's low should hold.

If the early bounce this morning starts to slip, we are likely to test the 100-day moving average (SPY $199) this week.

Last Friday, I outlined my trading strategy. I have been long out of the money December put credit spreads for a few weeks and they were in great shape until Wednesday. Option implied volatilities spiked and although the positions were profitable, I did not want to buy back my spreads when I thought they were still going to expire worthless. The stocks were still above technical support and they were out of the money. The easiest way for me to stick with the positions was to hedge them with S&P futures.

As outlined, I shorted the S&P futures when the SPY was below $203.90 on Friday. I set my target at SPY $202 and I took profits. The market rallied after hitting my target and the hedge worked perfectly. Later in the day, we fell below SPY $202 and I entered the short again using SPY $202 as my stop. The market fell apart and I started getting stopped out on my put credit spreads.

I am out of half of my put credit spreads. In some cases I lost a little money and in others, I made a little money due to time decay. When factoring in my hedge, I was way ahead of the game.

Using SPY puts (or the S&P emini) is a very effective hedging strategy during short-term market moves. I am able to maintain all of my other positions and weather the storm on an intraday basis.

Today I will hedge using Friday's low SPY $200.80 as my entry point. That will also be my stop. If the market declines to SPY $199 (100-day moving average) I will take profits. If it falls back below that level I will go short and I will use $199 as my stop.

I do not want to trade against seasonal strength. No overnight shorts!

I feel that I can catch most of these moves intraday and I still believe there will be a nice put selling opportunity into year-end.

The Senate extended the debt ceiling on Saturday and that is bullish.

The FOMC will remove the phrase "considerable time" on Wednesday, but they will soften the blow with new dovish rhetoric. The initial reaction might be negative, but the market will stabilize.

Greece is holding elections on Wednesday. If the coalition does not retain power, it will be bearish. However, the ECB plans to launch a sovereign debt purchase program and Greece will be bailed out.

Oil stocks have been pounded and the rate of decline will decrease. This means oil stocks won't weigh on the market like they have. Low gasoline prices are good for consumption and we will see a rotation into retail and restaurant stocks. Oil is used by many chemical companies and lower input costs will increase margins.

Christmas will divide the trading week and volumes will decline. This favors the bulls.

The economic news will dry up and the market should be able to find its footing this week. Option implied volatilities are elevated and that sets us up for a nice put selling opportunity.

As I write my comments, it is apparent that the early gains are vulnerable to profit-taking. I believe the market will test the 100-day moving average this week.

My risk has been reduced now that my December put credit spread position has been reduced. I will keep my day trading size the same so I will actually have more of a negative bias intraday.

Use the levels I've outlined to hedge and to go short on an intraday basis. This is looking like a nasty little reversal from the open and it could get ugly. If you are not out of your longs, make sure to hedge.

.

.

Daily Bulletin Continues...