ECB News Does Not Spook Buyers – Market Pushing Towards Resistance On Low Volume

Options trading strategy - My options trading strategy is to wait for a breakout or a breakdown. The market is trapped in a trading range and option premiums will be eaten away by time decay. We do not have any market momentum so option buying strategies are out of the question. I would be tempted to sell bullish put spreads, but one negative news event could put me in peril. The market technicals have been weak the last three months and I don't want to get blindsided.

All is not lost. I have been day trading the S&P 500 using the one hour range. If the market is above the first hour high, I go long and I use that as my stop. If the market is below the one hour low, I go short and I use that as my stop. I have also been trading the momentum during the last hour. These moves have been consistent and I can usually grab 4-5 S&P points. SPY call and put options can also be used effectively for this strategy.

Posted 11:00 Am ET - Last night I recorded an investment webinar. This strategy has averaged a 21% return the last 18 months and it does not use options. It performs well in bull or bear markets.

CLICK HERE TO WATCH THE INVESTMENT WEBINAR

Yesterday, the market took a breather after heavy buying this week. Stocks were trying to move higher into the closing bell, but late news spoiled the party. The ECB said that they would not let banks pledge Greek bonds for collateral. This will make it much harder for Greece to raise capital and the market plunged 15 S&P points on the news.

This morning, traders have digested the news. This was a prudent move on the part of the ECB and they want recently elected Greek leaders to understand who is in control. Greece is a dark cloud and it will loom over the market the entire year.

Germany's factory orders came in better than expected and the European Economic Council raised EU growth expectations for 2015.

The PBOC lowered bank reserve requirements by 50 basis points yesterday and many analysts believe that another move will be made shortly. Economic conditions are fragile and HSBC's PMI report came in at the lowest level in six months. I believe that China is the key to global markets. If they can maintain current growth levels, markets will float higher. If their economic activity falters, we could see a correction.

Domestic economic conditions are strong, but we could be seeing some warning signs. Last week durable goods orders and GDP disappointed. This week, ISM Manufacturing and ADP came in light. On the positive side, January US auto sales hit their highest level ever and ISM Manufacturing was slightly better-than-expected. Analysts are expecting 230,000 new jobs when the Unemployment Report is released tomorrow.

Earnings season has been fair, but guidance is cautious. A strong dollar has impacted earnings and it will impact exports later in the year.

Central banks continue to ease, but the news is not packing much punch. The ECB fired its bazooka and the FOMC statement was dovish. Furthermore, the PBOC reduced bank reserve requirements. The market has inched its way higher, but this news would have generated an explosive move six months ago. Traders realize that quantitative easing is not stimulating economic growth.

Oil is bouncing and we might have seen the lows. However, this basing process will take most of the year to form and this bounce will be short-lived.

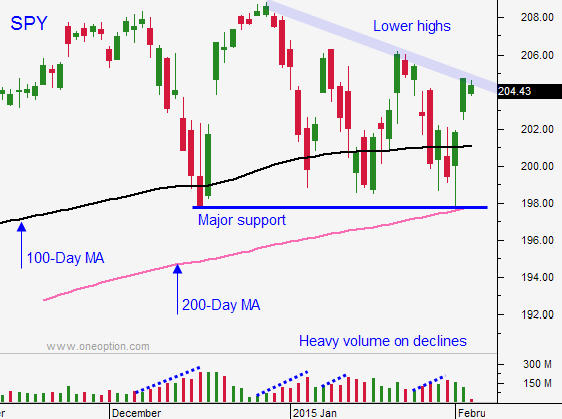

The market has been able to shrug off negative news and the rally the last few days has been strong. We should start hitting resistance as we get closer to the all-time high. Apart from a lack of attractive investment alternatives, I don't see a catalyst for a market rally.

Focus on individual stocks that are breaking through horizontal resistance, but keep your size small. The market is range bound and it could stay that way for a few weeks. Once we have a breakout or breakdown, the momentum will return and then we can purchase options knowing that we have the wind at our back.

.

.

Daily Bulletin Continues...