Market Bonce Should Stall Soon – Day Trading Has Been Very Effective – Use This Tactic

STOP WORRYING ABOUT THE MARKET ATTEND MY WEBINAR TONIGHT. I WILL REVEAL A COMPLETELY NEW INVESTMENT APPROACH. IT DOES NOT INVOLVE OPTIONS AND IT HAS VASTLY OUTPERFORMED MAJOR INDICES. THIS STRATEGY WORKS IN BULL AND BEAR MARKETS AND IT CAN BE AUTOMATED

CLICK HERE TO REGISTER

Posted 10:30 AM ET - Yesterday, the market continued to rebound. Once the early momentum was set, stocks continued to march higher. In the last few months resistance has been building and I don't believe we will challenge the high. In fact, I still feel that the next big move is down.

China lowered its bank reserve requirements by 50 basis points. The Street was expecting the PBOC to ease. HSBC calculates its own PMI for China and it hit its lowest level in six months. Economic conditions in China are fragile and I feel this is the biggest concern for bulls.

Europe's economic activity has stalled and the ECB's bazooka won't help. Central banks have been trying to "goose" global economies and this tactic has lost its luster. We did not get and ECB or an FOMC rally.

Greece will tone down its rhetoric to secure a much-needed ECB loan in a few weeks. Once they get it, expect fireworks. This dark cloud will loom over the market all year.

Domestic economic conditions are teetering. Durable goods orders, GDP, ISM Manufacturing and ADP have missed estimates. ADP reported that 213,000 new jobs were created in the private sector during the month of January. This number did not move the market. The Street is expecting 230,000 new jobs on Friday and anything close to expectations will be a non-event.

ISM services was inline.

Tension in the Middle East is rising (ISIS) and the conflicts in the Ukraine are escalating.

Earnings have been fair, but guidance is cautious.

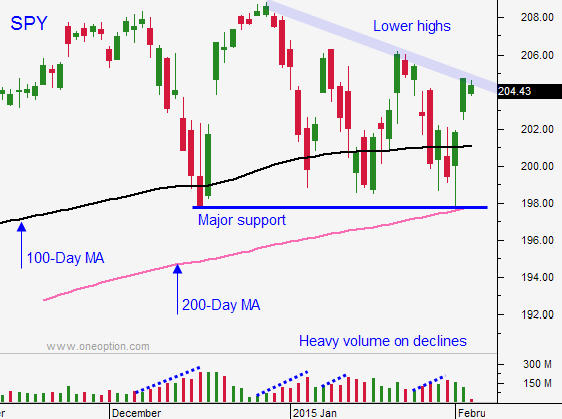

The market has rallied on low volume and it has declined on heavy volume (distribution). Major moving averages are being tested with greater frequency and we have a series of lower highs. These are bearish developments.

I still feel the next big move is down, but I won't buy put options until we close below the 100-day moving average for three straight days. By the same token, I am not buying call options either. The market volatility is extreme and I have been able to catch every move during the day.

Yesterday, I told you that I would monitor the first hour of trading and if the market broke through the high-end of that range, I would buy S&P futures. I was able to make 10 points Tuesday. A one lot trade requires $3000 in margin and it netted $500 and profit. That is a nice return. You can also use SPY call options. They are extremely liquid and they trade in penny increments.

I also told you to trade the momentum in the last hour. This strategy netted another five S&P points.

There is no benefit for overnight risk at this time. Once the market establishes the momentum, it continues throughout the day and the move is over-exaggerated into the closing bell. If I wanted to get long, I would be able to buy the pullback this morning and I would get in at a better price. The same is true during market declines. We see heavy selling pressure into the close and the next morning the market bounces.

I don't want to sell out of the money bullish put spreads because we could hit an air pocket. One bad day could put those options spreads into play and I don't want to risk it since my bias is bearish.

Look for choppy trading today. Use the one hour range as your guide. If we are above it, go long and use it as your stop. If we are below it, go short and use it as your stop. This is a very simple trading strategy and it has been effective.

.

.

Daily Bulletin Continues...