Momentum Has Stalled – Take Profits On Some of Your Call Options – Reduce Risk

Options Trading Strategy - I am long call options and I am focusing on the tech sector. It has been strong relative to the S&P and Dow Jones. I have reduced my risk exposure and if I see selling this afternoon, I will reduce it further. This is been my primary options trading strategy and I will go to cash if the market stalls. I'll wait to see what happens at SPY $209 and then I'll know my next course of action.

I have not been selling out of the money bullish put spreads. Option premiums are low and I have to go to close to the money to get a decent credit. One brief dip could put those positions in peril and I don't want to risk it at this time.

From a day trading standpoint, I have been buying the NQ (QQQ) on rallies and I have been shorting the ES (SPY) on declines. This is been an excellent strategy and being in the right instrument has “goosed” my profits.

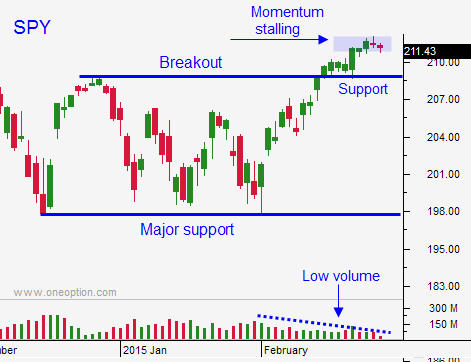

Posted 11:30 AM ET - The last few days the market has struggled to advance. Tech stocks are leading the way, but the Dow and S&P have lost their momentum. Without Apple, the NASDAQ 100 has only advanced .8% this year. We've seen afternoon selling and this rally feels tired.

After being trapped in a range for the last three months, I expected better follow-through on this breakout. The market has gotten every shred of good news and buyers are not engaged.

Yesterday, I sold some of my calls. I did not like the afternoon selling and as an option buyer, I need momentum. I also like to trade with a nice market tailwind when I am buying options and I don’t have one. As an option buyer I'm constantly worried about time decay.

Fed comments have been dovish, Greece got a loan extension, there is a cease-fire in the Ukraine, and China's flash PMI was better than feared. The market had all the news it needed to add to the breakout.

I read comments from a few Fed officials and they believe there is a disconnect with the market. Tightening could happen as soon as June and they fear that assets will be quickly repriced. Translation: the market will be shocked when they start and stocks will decline on the news.

Durable goods orders were flat (ex-transportation) and GDP came in slightly below estimates (2.3 versus 2.6).

Bullish sentiment is at an extreme and speculators will get flushed out sooner or later. In the last six months, when the market has broken out and the rally has stalled, we have rolled over.

The magic number is SPY $209. If we test it and bounce, all is fine. If support fails, we could see a nasty round of selling as speculators hit the exits.

Reduce risk and take profits on some of your call positions. Tech stocks have been leading the way higher and I believe they are close to running out of gas.

If you see selling later this afternoon, take more risk off the table.

.

.

Daily Bulletin Continues...