Market Has Lost Its Momentum – We Are Likely To See a Dip This Week – Take Profits On Calls

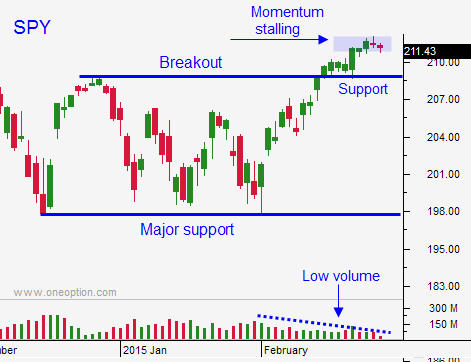

Posted 9:40 AM ET - After a prolonged three-month range, the market broke out and it looked like the rally would gain traction. Fed speak was friendly, Greece got a loan extension and the ECB approved QE. Unfortunately, we are not seeing any follow-through.

Friday I suggested taking profits on call positions. Options buyers need momentum. You can find that in individual stocks, but it helps to have a market tailwind and we don't have it. Time decay will eat away at these positions.

There is a bigger concern for call buyers. You don't want to be on the wrong side of the trade and the market looks poised for at least one down day this week. In the last few sessions we've seen late day selling and that is a bearish sign. Bullish sentiment is extremely high and speculators are vulnerable.

If you look at every breakout since August, the SPY has established a new high, the momentum has stalled and eventually the market rolls over and tests the 100-Day MA. I feel that we are in a similar pattern right now.

The Dow barely made a new high during this recent rally. It is almost below that breakout. The S&P has not rallied in more than a week and the news has been market friendly. The NASDAQ 100 is up 4.8% this year, but it is only up .8% if you strip out Apple. On that note, Apple has rolled over and it looks toppy.

The news over the weekend was good, but we are not seeing much of a market reaction. Official PMI's in the EU and in China were in line. The PBOC lowered interest rates by .25%. This was big news and it failed to attract buyers.

ISM manufacturing will be posted 30 minutes after the open. Recent domestic economic releases have been soft.

Fed officials keep referencing a “disconnect”. They feel the market has not properly discounted a rate hike. Translation: tightening might happen in June and the market is not prepared. The probability of “patient” being removed in the March FOMC statement is high.

Stocks have rallied into the jobs number for many months. However, this time could be different. If we see more than 250,000 new jobs, the probability of a rate hike in June will increase and the market will decline.

The wage component will also be scrutinized. Many states (21) have raised the minimum wage and this is the biggest input cost for companies. Profits will go down and eventually prices will rise. Wage increases always lead to higher inflation.

The fact that the market has not been able to rally on good news concerns me. I feel that at very least we will have one significant down day this week. First support is SPY $209. If that support holds, we will bounce and chop around for a few more weeks. If it fails, we could see a heavy round of selling that challenges the 100-Day MA.

I just barely started taking overnight positions and here I am on the sidelines. I did make a little money on the rally and I was in a position to make a lot of money if the breakout gained traction. Unfortunately, that didn't happen. Now that I've seen the price can price action, I believe that bullish speculators are going to get flushed out.

I will day trade and I will favor late day selling.

My options trading strategy is to sell out of the money call credit spreads on stocks that broke out and rolled over. The breakout is muy stop. This will be a VERY small 5% allocation and it will generate a few dollars while I wait for the dip. I don't like trading against the trend and option implied volatilities are low so I need to focus on stocks where the IV is above .4.

Patience will pay off.

Daily Bulletin Continues...