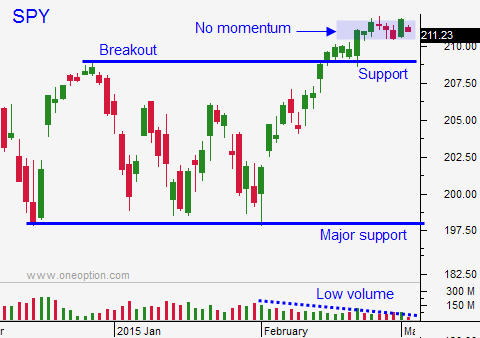

Tight Range – Low Probability Environment – Keep It Small – We Need A Decline To Shake Things Up

Posted 10:20 AM ET - Yesterday we saw some follow-through selling and the lows of the day were established early. Prices stabilized and the damage was contained. This brief dip did not shake bullish speculators out of positions. We need to see three days of heavy selling and we need to test SPY $209 for that to happen.

The ECB will purchase bonds into 2016 and QE has put a bid under European markets. China lowered its growth projection for 2015 to 7%. This was largely expected.

The market has had a tendency to rally into the jobs report and we are seeing some buying this morning. I believe the number will be in line (235K) or below. This would be bullish for the market since tightening fears would temporarily subside.

Initial jobless claims hit a low a few weeks ago and they have been creeping higher. Low oil prices are taking a toll on jobs and that industry. Retail sales have been flat and there could be job losses in that sector as well. ADP missed estimates yesterday and it came in at 212K. The Challenger Report this morning showed that there were 50,000 planned layoffs in March. The horrible weather in the Midwest and on the East Coast could also reduce employment.

Any bullish reaction to the number will be offset by hourly wages. Many states have raised the minimum wage and that will put upward pressure on inflation. Tomorrow's jobs report will be mixed (Goldilocks jobs but wage inflation) and the reaction will be negligible.

The market has been compressing in a tight range and we need a decline to shake things up. A small round of profit-taking will shake out bullish speculators and it will reveal support. If we don't fall very far, we will know the bid is strong. If we take out SPY $209, we will know that buyers are not very aggressive and that we could test the 100-day moving average.

If we don't get a decline, we will be trapped in this tight trading range.

This is a low probability environment, keep your trades small.

I did buy a few put options in the oil services sector. Some of those stocks rallied off the low and they are rolling over.

I am keeping my powder dry until we get a pullback. The bid is strong and so is resistance. This could be a boring day once we establish the one hour range. Most traders will wait for the jobs report Friday.

I don't think we will get much of a reaction to the number and we could be in for a quiet stretch next week.

.

.

Daily Bulletin Continues...