Expect More Selling – 200-Day MA Will Be Challenged – Use SPY $205.70 As A Guide

I post my market comments before the open in my trading platform. I also post play-by-play comments on busy days like Wednesday. Profits on a day like yesterday pay for the platform for a year.

CLICK HERE FOR MORE INFORMATION

Posted 12:00 PM ET - It's funny how the market tone can change in a matter days. I've been mentioning that bull markets are not dependent on tiny countries like Greece or one word in an FOMC statement. If this rally had any "teeth" it would power higher in the presence of bad news.

We started to see some warning signs last week. The Fed made dovish statements last Wednesday. The market rallied and it gave back the gains the next day. Stocks tried to rally Monday and we saw heavy selling in the last 30 minutes of trading. That pattern repeated on Tuesday and I knew we were in trouble.

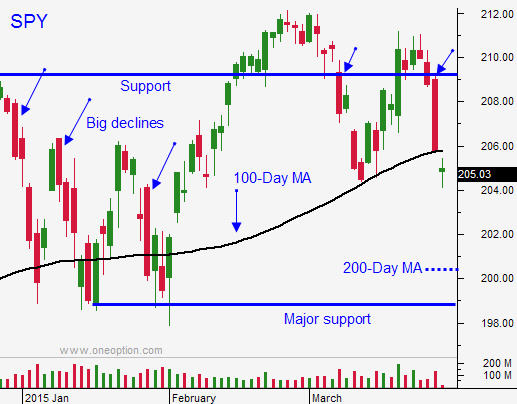

Once the momentum was established yesterday, we took out support at SPY $209 with ease. By the end of the day, we challenged the 100-day moving average. During the last market selloff we did not penetrate the 100-day moving average. We never established a capitulation low and I suspected that we had more work to do on the downside.

Yesterday, I bought back my bullish put spreads when we broke below SPY $209. I was short the S&P futures the entire day and I took profits. I did not want to carry any overnight positions since we were likely to get a bounce this morning.

Look at the chart of the SPY this year and note the other long bodied red candles. You'll see that after each decline we saw follow-through selling in the next day or two. I believe we will test the 200-day moving average ($201) in the next few days. It might only happen on an intraday basis and you have to be quick to take profits.

Ignore the headlines and focus on the price action.

The market has tried to selloff and it has tried to rally today. I am using the first hour high as my guide (SPY $205.30). If we are below it, I am short. I will not trade from the long side today. Any bounce will be short-lived.

This round of selling should run its course next week. Earnings season will start in 10 days and that should attract buyers once the capitulation low has been established.

I prefer to day trade from the short side during these declines. The market has a tendency to selloff hard into the close and to bounce the next morning. This pattern gives me an opportunity to reload and I don't have overnight risk. I don't like being short overnight when one central bank statement can spark a massive rally.

Let me contrast this with buying calls. Once the capitulation low is in, I am very comfortable buying calls and holding those positions overnight. The market tends to grind higher and the rallies take longer to unfold.

Use $205.30 as your guide. If by chance we rally above SPY $205.70 (100-Day MA), I will use that as my entry point for shorts.

If you are waiting to buy this dip, be patient. We still have more work to do on the downside.

.

.

Daily Bulletin Continues...