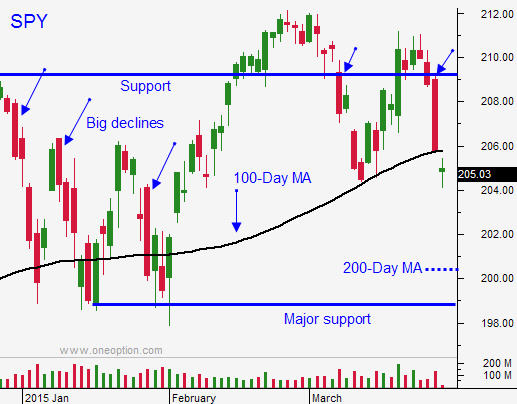

Market Won’t Rally Until We See Panic Selling – Use the 100-Day MA As Your Guide

Do you trade AAPL, NFLX or BABA? Check out our trade signals for any stock. We launched our new website and you can get trade signals for as little as $20.

VISIT OUR NEW SITE

Posted 11:00 AM ET - The nasty selloff on Wednesday will keep buyers at bay. Huge declines have a tendency to follow through and I believe we will see additional selling in the next few days. The SPY finished below the 100-day moving average yesterday and traders will error on the side of safety heading into the weekend. The price action today will be choppy and we should see some selling late in the day.

Q4 GDP came in at 2.2%. This is a light number and economic growth is very sluggish. Corporate profits were down 3% versus a 2.8% increase in Q3. This is the biggest decline in profits since 2011.

Many states have increased the minimum wage and this will bite into profits. Labor is by far the largest input cost. A strong dollar will also hurt multi-national profits when foreign currencies are converted back to dollars. On a longer-term basis, exports will decline because of the strong dollar.

SanDisk warned yesterday and that will cast a dark cloud on the tech sector. Earnings season is 10 days away and we could see additional warnings.

There are plenty of negative headlines. The plane crash in France, conflicts in Yemen, Greece, soft economic releases and earnings warnings are just a few of them.

We have not seen panic selling yet. I believe the market will challenge the 200-day moving average and we need to see a capitulation low. This should develop in the next few days.

I am shorting the S&P on an intraday basis. The SPY is above $205.70 and if we fall back below it, I will get short. I will use that as my stop. If the position is profitable after 5 minutes I will lower my stop so that I can't lose money on the trade. The price action has been very choppy so far. I expect to see late day selling and that is the move I want to catch.

I won't hold any overnight short positions. The market is not trending and I don't want to be blindsided by a central bank move.

We are in a five-year bull market and I won't aggressively buy puts until we close below the 200-day moving average for a number of consecutive days. Until that happens, I have to assume that every decline is a buying opportunity.

If we fall below the 100-day moving average today, get short and use that as your stop. If we get a big decline this afternoon, take profits heading into the weekend. Big declines usually result in a bounce the following morning and you should have an opportunity to reload Monday (provided that there aren't any surprises over the weekend).

.

.

Daily Bulletin Continues...