Market Roars Back – Sell Bull Put Spreads – Take the Free Trial

I am offering a FREE TRIAL and you can see every new trade signal for every stock. Check your stocks. CLICK HERE TO REGISTER

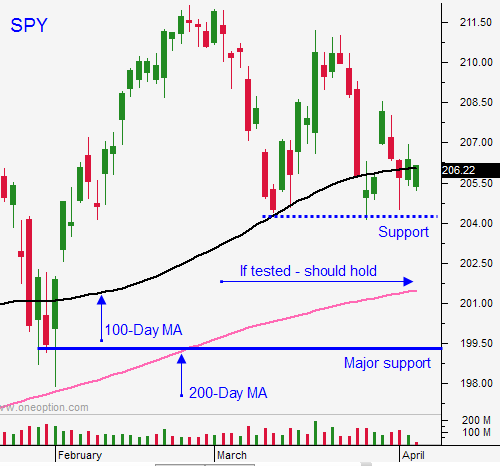

Posted 9:30 AM ET - Monday, the market tanked on a weaker than expected jobs report. The SPY opened below the 100-day moving average and it looked like we were in for a nasty day. Stocks shot higher and they never looked back.

The initial decline left me scratching my head. If you read Thursday's comments, I was looking for a weak number and a "bad news is good news" rally. When the S&P sold off, I thought that traders might finally be paying attention to economic conditions.

Needless to say, I did not get short. Once we rallied above SPY $206, we never challenged it. I did sell a few out of the money April put spreads and I will sell more today. I believe that support at SPY $206 will hold through April option expiration. If it is challenged, I will hedge my positions by shorting the S&P futures on an intraday basis. If we stay above $206, my trades will be on autopilot and time decay will take care of the rest.

Bullish put spreads allow me to distance myself from the action. I am still expecting choppy price action in a directionless market that is trapped in the middle of a range. Make sure that technical support rests between the short strike price and the stock price. If support is breached, buy back your bull put spreads.

Earnings season kicks off tomorrow, but it won't crank up for another two weeks. The early reactions should be positive, but that will wane as the announcements build. Earnings declines are expected across almost every sector (not just energy).

The FOMC minutes will be released Wednesday afternoon. This should be a non-event. If the minutes are hawkish, traders will expect them to soften after Friday's dismal Unemployment Report.

There isn't much news to drive the market. The energy sector has some attractive put selling opportunities. Utility stocks have cheap options and I like buying calls in this sector. The Fed will raise rates in June and these stocks have been beaten down.

Keep it small and keep your distance. The market is filled with cross-currents and there is no momentum.

.

.

Daily Bulletin Continues...