SPY $206 Will Hold – Sell Bull Put Spreads – Take the Free Trial

I am offering a FREE TRIAL and you can see every new trade signal for every stock. Check your stocks. CLICK HERE TO REGISTER

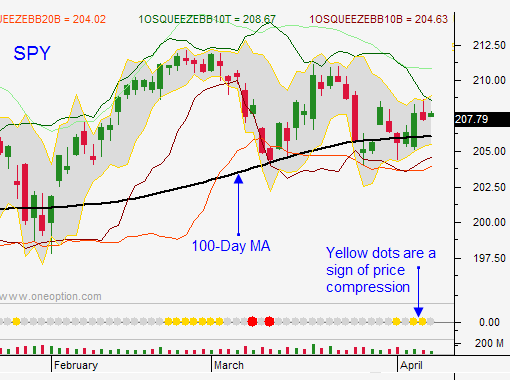

Posted 9:50 AM ET - Monday, the market reversed sharply after a weak jobs report and the S&P finished above the 100-day moving average. Stocks tried to add to the gains yesterday, but we saw selling late in the day. As long as the late day selling does not become a pattern, there's no need to be concerned.

The FOMC minutes will be released this afternoon. I don't believe this release will spark much a reaction. If the minutes are hawkish, most traders will assume that the tone will soften after Friday's Unemployment Report.

Alcoa will kick-off earnings season after the close. Major releases don't start until Tuesday (JPM and WFC). Earnings season typically attracts buyers and the bid should be solid through April options expiration.

I have been selling out of the money put credit spreads (bullish put spreads) the last couple of days. I am distancing myself from the action and I am making sure that there is technical support between the stock price and the short strike price. If technical support is breached, I will buy back the spread. Energy, transportation and tech are currently my favorites. I'm looking for stocks that have been beaten down and that have formed a base.

If the SPY trades below $206, I will hedge my positions by shorting the S&P futures on an intraday basis. I am expecting the 100-Day MA to hold, but I'm ready to execute this part of the plan if I need to.

The price action should be very boring. There are not any major news events to push stocks one way or the other. Trading volumes are low and we are stuck in the middle of this trading range.

After April options expiration, I'm expecting more movement. Ideally we will rally to the upper end of the trading range and that will set up a shorting opportunity. I believe that Q1 earnings will be soft and that guidance will be cautious.

This will not come as a shock to you - Greece will run out of money in May. There are a few storm clouds ahead and we are likely to get the long-awaited 10% correction in the next couple of months.

For now, keep your distance and sell some out of the money April put credit spreads. Let time decay work in your favor.

The chart shows a technical study I use. It displays multiple volatility bands and when they are all inside of each other yellow dots appear. The idea is to wait for a breakout (green or red dot).

.

.

Daily Bulletin Continues...