Use the FREE TRIAL To Find Bullish Put Spreads – Use Live Help If You Need It

I am offering a FREE TRIAL and you can see every new trade signal for every stock. Check your stocks. CLICK HERE TO REGISTER

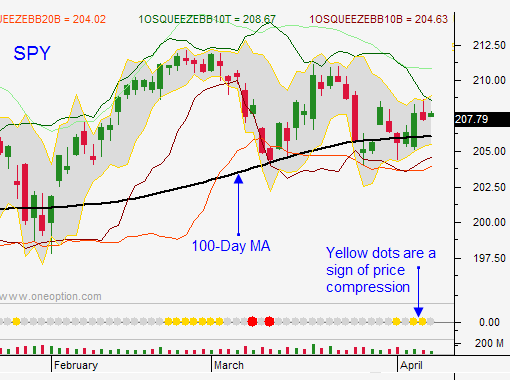

Posted 10:40 AM ET -The market is above the 100-day moving average and the price action since Friday's dismal Unemployment Report has been bullish. Earnings season kicked off yesterday and the strongest companies announce early in the cycle. This usually keeps buyers engaged and I believe the 100-day moving average will hold through April option expiration.

Since October, the market has been trapped in a range between SPY $198 and $212. A smaller range has formed ($205 - $210) and prices are compressing. The market is above the 100-day moving average and the news is light. I don't see a catalyst either way so I am selling out of the money put credit spreads (bullish put spreads). I'm focusing on stocks that have been beaten down in the energy, transportation and tech sectors.

If you have not taken the free trial, you should. The trading system has nailed stocks like BIDU. BABA, QIHU, SOHU, APA, HES, SLB and countless others. I'm using buy signals off of a base for my put writing.

Alcoa posted a decent number, but they lowered revenue guidance from 7% to 6.5%. The reaction was fairly muted. JP Morgan and Wells Fargo will post next Tuesday. Earnings season won't crank up for another two weeks.

Companies are mentioning wage pressure with greater frequency. They are paying more to hire good people. This is good wage growth (versus states hiking the minimum wage rate) and it bodes well for economic growth.

China will post major economic releases Monday and Tuesday. I believe the numbers will be weak, but most analysts feel that the PBOC will ease as much as they need to. Unfortunately, monetary actions have not stimulated economic growth.

Greece is approaching another deadline in a couple of weeks. Many analysts feel that the EU could cut them loose and the sentiment seems to be shifting. If Greece is allowed to default, it could come as a sign of strength. The EU is not going to support countries that do not honor fiscal obligations. I believe European banks will be able to shoulder the hit. Sovereigns will take most of the blow.

We are trapped in a range within a range. Buyers and sellers are paired off and the market lacks a catalyst.

I sold April out of the money put credit spreads and I am letting time decay work in my favor. If the SPY trades below $206, I will short the S&P futures on an intraday basis so that my put spreads are hedged. As long as we stay above SPY $206, I am on autopilot and stocks can chop back and forth all they want.

Look for lackluster trading the rest of the week.

.

.

Daily Bulletin Continues...