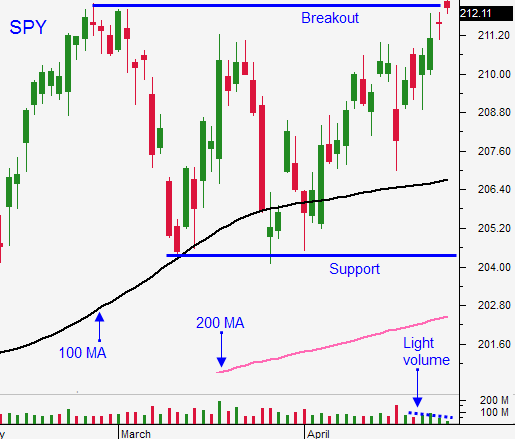

S&P Breakout Did Not Hold – Resistance Still Intact – Use SPY $210

Posted 9:30 AM ET - Yesterday, the market opened in positive territory and the S&P 500 made a new all-time high. Apple earnings were scheduled after the close and bulls had all the ammunition they needed to force a breakout. As the day progressed, profit-taking set in and the breakout did not hold. Stocks are a little soft this morning.

Apple posted a 27% increase in revenues and a 33% increase in profits. They increased their dividend and the stock is up three dollars. Apple knocked the cover off the ball and the stock was barely able to make a new high. With mega cap tech stocks (GOOG, FB, MSFT, NFLX, AMZN and AAPL) out-of-the-way I feel more comfortable shorting. These companies announce early in the earnings cycle and optimism builds quickly.

I was hoping for a breakout Monday. That would have lured bullish speculators in and solid performance from Apple would have fueled it follow-through rally today. With the SPY above $212 it would have been easy to get short when that level failed.

Resistance is still intact and we have to wait. Q1 GDP will be posted tomorrow and I'm expecting a number in the 1% range. This is meager growth, but the market won't care. The focus will quickly shift to the FOMC statement tomorrow afternoon. The Fed will remain dovish and the timetable for a rate hike is still September (or later).

I sold some of my calls yesterday when the market was not able to hold the early rally. If we close below SPY $210 today, I will exit the remaining positions. I barely started building my call position so my exposure is relatively small.

The selling pressure will build every day that the SPY is below $212. If the breakout is in the cards, it needs to happen soon. Once the FOMC is out-of-the-way I will buy puts if I see late day selling. I will add if the market closes below the 100-day moving average (SPY $206.70).

Prices could swing either way in the next two days of trading and we need to see which scenario plays out. I don't care if the market reverses this week or in two weeks. The short side still holds the most promise.

Energy and retail sectors will start posting and the results will be weak. We've seen the best part of earnings season and it has not fueled a breakout. Stocks are rich at a forward P/E of 18.

I will be day trading the next two days and I will be evaluating the price action.

The S&P 500 was down 9 points earlier this morning and it has been able to recover. Global markets are a little soft.

Good earnings from Apple and the FOMC tomorrow should keep buyers engaged. I don't believe we will see heavy selling today. Use SPY $210 as your guide for call positions.

Keep it small until the FOMC.

.

.

Daily Bulletin Continues...