S&P Makes A New All-time High – But Don’t Expect A Massive Breakout

Take the Free Trial and get all of my trade signals

CLICK HERE

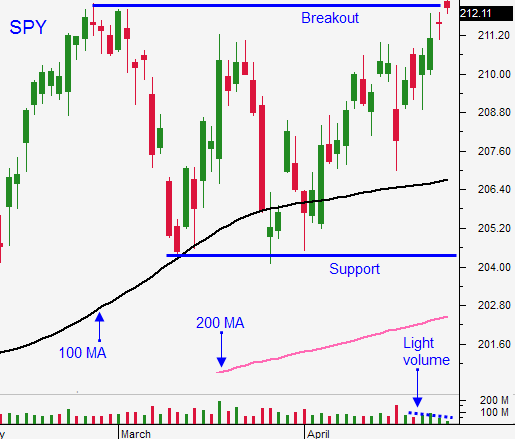

Posted 9:40 AM ET - Last week, the market ignored weak flash PMI's and the NASDAQ made a new all-time high. Mega cap tech stocks like Netflix, Facebook, Google, Microsoft and Amazon fueled the move. The S&P 500 is likely to make a new all-time high this morning.

If the market was not able to breakout before Apple's earnings (today after the close), I felt that a reversal could start as early as this week. Now that we have the breakout, prices should be stable for a couple of weeks and we should be able to get through May option expiration without any major declines.

Bullish speculators will get lured in and stocks will grind higher. I'm not expecting a big breakout and the SPY would be lucky to reach $217 before profit-taking sets in.

I consider this a moderate probability trading environment and I'm keeping my size relatively small. Swing traders can focus on selling out of the money put credit spreads. The strategy will allow you to keep your distance and time decay will work in your favor. Day traders can get long, but make sure to use stops and set targets. Once the momentum stalls, exit long positions. In particular, watch for late day selling. That will be a sign of exhaustion.

Apart from mega cap tech stocks, earnings have not been stellar. Stocks are trading at a rich forward P/E of 18 and guidance has been soft. Minimum wage hikes will bite into profits and the strong dollar will weigh on exports. I believe there is room for profit-taking at this level and I don't sense that Asset Managers feel compelled to buy at this level.

Global economic conditions continue to slip. Fitch lowered Japan's credit rating over the weekend.

Q1 GDP will be posted Wednesday morning. Analysts will blame bad weather and a host of other "one-time events". We've been looking for pent-up demand for more than a year and consumers remain cautious. Many analysts feel that Q1 GDP will come in around 1%. This news will soon be forgotten and the focus will immediately shift to the FOMC statement later that day. Stocks have rallied into the Fed and they are likely to continue that pattern Wednesday. I'm not expecting a rate hike before September.

Greece continues to inflame EU members. The bailout talks did not go well this weekend and I am expecting Grexit this year. The initial reaction could spook investors, but credit risk is relatively contained. This default will not surprise anyone and this has the potential to be bullish for the EU on a longer-term basis.

May is a seasonally weak period and we are at the top of the trading range. I feel that bullish speculators will get sucked in and the breakout will fail in a few weeks. The market will test the 100-Day MA and if Grexit looks likely, we could test the 200-day moving average.

I am trading from the long side for the next couple of weeks. My overnight exposure is relatively small and I am buying calls on stocks that are breaking out and that have recently generated a buy signal on my trading system.

The price action should be bullish today ahead of Apple's earnings. Good news is priced in and I believe Apple will deliver. Shares will challenge the high, but a massive breakout is unlikely.

.

.

Daily Bulletin Continues...