Market Will Probe For Support Early – Prices Should Hold Today

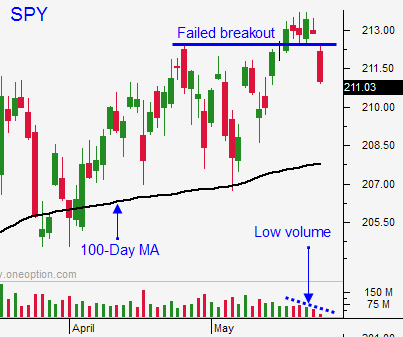

Posted 9:40 AM ET - The market started the week off on a sour note and the SPY fell below $212. The breakout failed and bullish speculators were flushed out. Once the selling momentum was established, Asset Managers pulled bids.

Traders often take extra time off around holidays and there was no one to stand in the way of yesterday's decline. The breakout last week came on light volume and the level of conviction was low. Tuesday's selloff came on heavy volume and that is slightly bearish. I'm not going to read too much into the move since we are coming off of a major holiday.

I viewed last week's rally as the path of least resistance. Stocks typically move higher into Memorial Day. That breakout sucked bullish speculators in and the decline yesterday flushed them out. This move had more to do with an absence of buyers than it did profit-taking.

Stocks have been trapped in a range for many months and there is no follow-through. Consequently, the 100-day moving average (SPY $208) should hold this week.

Durable goods orders fell .5% and that was in line with expectations. GDP will be posted Friday. The news will pick up next week and traders will not take large positions either way ahead of the numbers (ISM manufacturing, ISM services, ADP, ECB rate decision and the Unemployment Report).

My bullish put positions lost a little breathing room yesterday, but they are still in great shape. Time decay is working in my favor and my profits will increase every day that the market treads water.

If by chance the SPY trades below $208, I will start hedging.

There wasn't any news to justify the rally last week and there wasn't any news to justify the decline yesterday. This is nothing but noise.

The market will probe for support early this morning and it should find it. Stocks will bounce and the rest of the week should be quiet.

I'm not expecting it, but a gradual drift lower today and selling into the close would be a bearish sign. If I see that price action, I will exit some of my long positions to reduce risk.

I am not adding to positions, I am managing risk.

.

.

Daily Bulletin Continues...