Breakout Needs To Hold – Use SPY $212 As Your Guide – Manage Risk

Posted 10:50 AM ET - Today the market is suffering from a holiday hangover. Many traders are extending their time off in this news vacuum. I did not get overly excited about the light volume breakout last week, and I'm not too concerned about the decline this morning.

Durable goods orders fell .5% and that was in line with expectations. The next big news will come on Friday when GDP is released. A week from now, ISM services, ISM manufacturing, ADP and the Unemployment Report will be posted. Most traders will wait for that news.

Asset Managers will not chase stocks at an all-time high when they are trading at a forward P/E of 18. The market bid is frail at this level. Global economic conditions are tenuous and the FOMC statement in June will set the timetable for possible rate hike.

My risk exposure is small. I sold out of the money put credit spreads two weeks ago and they are in nice shape. I would like to hold them through the week if I can because time decay will whittle away at the premium.

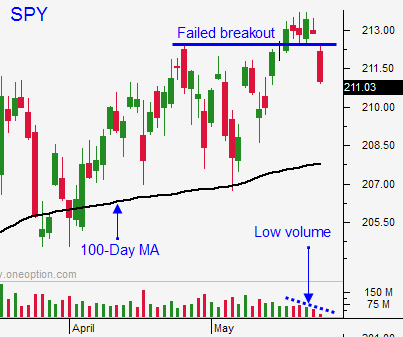

The SPY is below the breakout at $212. Bullish speculators who bought the breakout are feeling some heat today and that will increase the selling pressure as they cut losses. This wave of selling should soon run its course.

If the market is not able to bounce this morning, I will buy back a few of my bullish put spreads. If the market closes below SPY $212, I will buy a few more of them back. I have profits in these positions, but I know they will increase if I can hang on for a few more days.

I am also long low-priced stocks that have recently broken through horizontal resistance. As long as the breakout holds, I will stick with the position.

I am expecting light volume and choppy conditions this week. Greece needs to secure major financing in the next few weeks and it is providing a bit of an undertow.

This is a low probability trading environment. To use a driving analogy, my car is idling forward and I have my foot covering the brake.

I am riding out my bullish put spreads and I am monitoring my risk very closely. I don't plan on adding positions today. I am in risk management mode.

Use SPY $212 as your guide.

.

.

Daily Bulletin Continues...