Buy Cheap Stocks That Are Breaking Out – Strategy Has Been Great – Take the Free Trial

CLICK HERE TO TAKE THE FREE TRIAL. You will see today's trades in the chat room and you will see the stocks in Pete's List. I bought one stock for $18 yesterday and it is over $20 this morning.

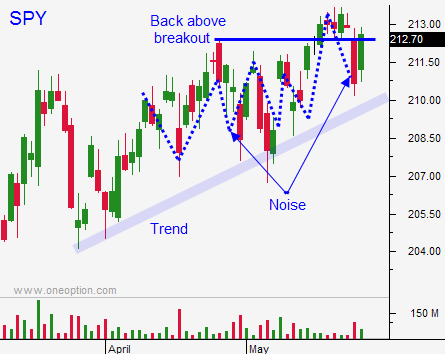

Posted 9:25 AM ET - The S&P 500 broke out on light volume last week. The breakout has been tested the last few days and stocks are trying to tread water.

Durable goods orders fell .5% and today we learned that GDP was down .7% in Q1. These are dismal numbers, but Asset Managers are discounting the news on the notion that pent-up demand will spark a rebound in activity.

Major economic releases are slated next week (ISM manufacturing, ISM services, ADP, ECB rate decision and the Unemployment Report). I hope these numbers generate a big move because we could fall into the summer doldrums. The next major release after that is the FOMC on June 17th.

China's market has been on a tear and it is up more than 40% this year. It fell 6% yesterday and it tanked overnight before finding support. It is unchanged for the day and that could be the end of the dip. Some Chinese brokerage firms are raising margin requirements and I believe that spooked investors. China's market is still up 4% in May.

Economic conditions are soft and stocks are trading at a forward P/E of 18. I don't trust this market. Stocks have not been able to push through resistance, but we lack a catalyst. Consequently, my strategy has been to sell out of the money bull put spreads. These positions are in great shape and I am taking advantage of time decay. I'm also able to keep my distance. I'm gradually making money each day.

I also have another strategy that I've been using with excellent success. I'm using my scanner and my trading system to find low-priced stocks that are breaking through horizontal resistance. My plan is to swing trade these stocks, but sometimes they shoot higher and I can't resist taking profits in this directionless market. I always know that I can get back in. These breakouts tend the last a few days or more. I don't have to worry about time decay or liquidity since I'm trading the underlying shares. These stocks have tremendous buying pressure and even if I'm caught on the wrong side of the market (i.e. Tuesday), they are holding up extremely well.

I search for the symbols each day and I at them to Pete's List. If you take the Free Trial, you will have access to these stocks. Look for the cheap ones that are breaking through resistance and you will be in business. There is one that is flying higher today.

Sooner or later, this five-year bull market was going to run out of steam. The trend is weakening and the market is range bound. You need to adjust your trading strategies accordingly.

The market will probe for support early this morning after a weak GDP number. Traders are not going to take large positions ahead of major releases and the damage should be relatively contained. China's rebound off of the lows should also calm nerves. There is support at SPY $212 and I believe it will hold today.

Once the early action settles down, we are likely to fall into a tight trading range the rest of the day.

Let's hope for some heavy action next week.

.

.

Daily Bulletin Continues...