Mega Cap Tech Will Push the Market To the All-time High Next Week

CLICK HERE TO WATCH LIVE TRADING TODAY. We have been making a killing in my chat room and you will see me post all of my trades in real-time. This link will launch a support chat so that I can register you and get you started. We have been making a killing every day for months trading 1 specific pattern

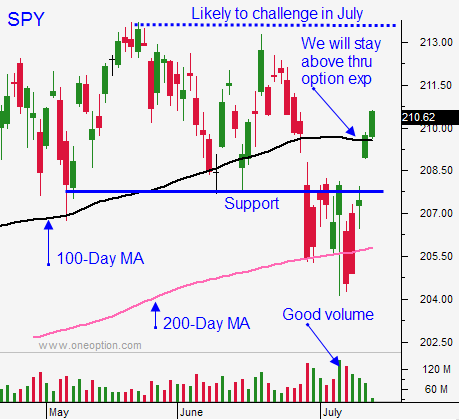

Posted 11:30 AM - ET - The market has been able to bounce off of support and rally above the 100-day moving average this week. Now that Greece has agreed to a deal and Chinese markets have stabilized, the overnight risk profile has improved. I believe the 100-day moving average will hold through options expiration.

In the last few months, we haven't had many stretches where the market sustained a directional move for more than a day or two. Last week, I suggested buying calls and selling out of the money put credit spreads on the notion that we would get a 3-4 day rally. This strategy has worked well. The gains from this point on will be hard-fought as we approach the all-time high.

Mega cap tech stocks (Amazon, Google, Microsoft, Facebook and Apple) will fuel the next leg of this rally. We should test the all-time high, but I'm not expecting a big breakout.

This morning, Janet Yellen said that a rate hike this year was likely barring any surprises. The market has been able to shoulder that news.

The FOMC will release its statement on July 29th. That is the last meeting until September and I'm not expecting them to show their hand. Interest rate worries should remain relatively contained the rest of July.

China's GDP and retail sales came in better than expected. Their market was down 3% overnight and the bounce might be getting a little tired.

I have been setting targets on my longs and I have been reducing overnight risk. As long as my positions show underlying strength, I will stick with them. If the momentum stalls, I will take profits.

Earnings season is going to take off and my focus will shift to trading those breakouts.

I love selling put spreads after bullish earnings releases. I feel the macro environment will be stable for at least a few weeks and I will be selling out of the money bullish put spreads in August.

If you have big profits, protect them. The market won't help or hinder your positions so make sure you have sustained underlying strength in the stock.

The market should be choppy with a slight upward bias the rest of the week.

.

.

Daily Bulletin Continues...