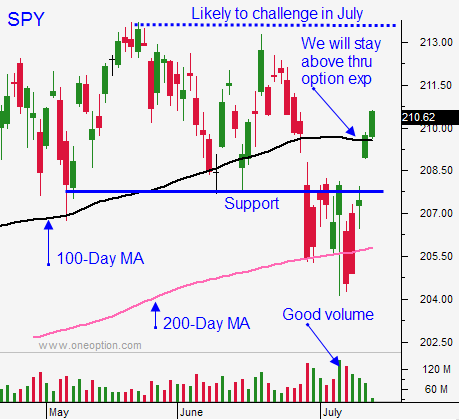

Watch Live Trading Today – Market Will Challenge the All-time High In July

CLICK HERE TO WATCH LIVE TRADING TODAY. Launch the chat and I will grant you access to my chat room where I post live trades.

Posted 11:30 AM - ET - Yesterday, the market opened higher and as forecasted, it rallied to the 100-day moving average. After a small pullback this morning, we are firmly above support. I expect SPY $209.60 to hold through option expiration and the price action should be positive this week.

As I mentioned in yesterday's comments, I am holding overnight long positions for the first time in months. The risk profile has improved dramatically in the last few days.

China's market has stabilized and the lows are likely to hold the rest of the month. Trade balance numbers improved and tomorrow they will post GDP, industrial production and retail sales. We could see more stock selling in the next few months, but the bleeding has temporarily stopped.

Greece caved in and they signed a deal. This never ending saga will continue until they default. They “can” has been kicked down the road and there is less uncertainty.

Earnings season will crank up this week. Wells Fargo and JP Morgan are trading higher after announcing results. Banks should perform well ahead of a potential interest rate hike in September. Mega cap tech stocks will post in the next couple of weeks and they are likely to push the market up to the all-time high.

The FOMC will meet on July 28th. They are not likely to show their hand and this is the last meeting before September. I don't believe interest rate worries will surface until August.

I have been selling out of the money bullish put spreads and I have been buying call options on stocks that are breaking out through horizontal resistance. This has been an incredible few months and subscribers have been making a killing.

If you want to see my live trades today, click the link at the start of this blog and I will grant you access to the chat room today. You will see a bunch of very happy traders.

Stay long and look for positive price action through July option expiration. We should challenge the all-time high sometime this month.

.

.

Daily Bulletin Continues...