Market Likely To Tread Water At the Low End of the Range – Late Day Selling Would Be Bearish

If you like to buy options on stocks that are breaking out, sign-up for this system - Special Offer $99/quarter through Sunday. CLICK HERE FOR MORE INFORMATION.

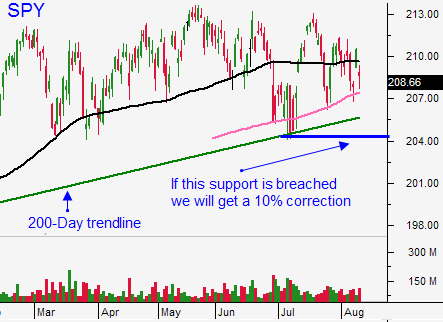

Posted 9:15 AM ET - Wednesday the market breached the 200-day moving average and we saw a swift reversal. That momentum continued yesterday and it looked like a nice rally was underway. In the last hour of trading, the bottom dropped out and the S&P closed in negative territory. We can expect choppy light volume trading near the low end of the range next week.

In my comments yesterday I told you to watch for late day selling. This is the first event and I'll be watching for a pattern. If we see this in coming days, it will be a warning sign. If the SPY trades below $207.60, I will buy puts.

Conditions in China are tenuous and one bad economic release will spook investors. Flash PMI's will be released a week from Monday and that is the next big number.

The next time you hear an analyst talk about how great the recovery in Europe is, realize they are growing at a meager .3%.

US retail sales rose .6% and that was a fairly decent number. However, retailers are posting dismal results.

The September FOMC meeting will keep a lid on this market. We could chop around at the low-end of the range, but any whiff of bad news will spark profit-taking.

As long as the market treads water, I will day trade. There is a technique I use to determine if the market is going to be range bound or if it is going to trend.

If the market breaks out of the one hour range, I trade in that direction. Momentum tends to build when the volume is light. If the market can't breakout of the one hour range, I trade reversals. For instance, if the market is near the high end of the range, I look for stocks to short.

Welcome to the summer doldrums.

A gradual drift lower from here would be bearish. That would be a sign of natural selling (not news driven).

Use the 200-day moving average as your guide.

I am expecting a quiet day today.

.

.

Daily Bulletin Continues...