Market Support Held and the Doldrums Will Set In – Watch For Late Day Selling

I just launched a new option buying subscription and I am offering it for $99/quarter. My search algorithms find the pattern we trade and then it filters for options with excellent liquidity that have IVs < 35. I am alerted when these potential trades are triggered and I visually confirm the pattern. I trade according to my market bias and I accept or reject the trade. This will keep us on the right side of the action and only the best trades will go through. Text and email alerts are sent. CLICK HERE FOR MORE INFORMATION.

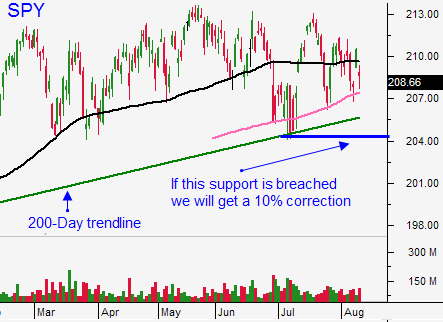

Posted 9:30 AM ET - Tuesday I told you to buy puts and we got a nice selloff Wednesday morning. When the market failed to make a new low after the first hour, I started to take profits. If you held off until the SPY rallied above the 200-day moving average, you still should have made money if you bought puts Tuesday. Support is holding and we could be in for a quiet stretch.

China's retail sales were the key to yesterday's reversal. If the number had missed expectations, the market would have closed well below the 200-day moving average and we could have hit an air pocket. China's industrial production was also in line and that helped.

US retail sales increased .6% and that was in line. The FOMC statement last month was benign and the minutes next Wednesday should not spark much of a reaction. Flash PMI's are the next big news event and they are scheduled 10 days from now.

Earnings season is winding down. We are hearing from retailers this week and the results are dismal.

Traders are on vacation and the volume is light.

Asset Managers are nibbling at this major support level, but no one feels like they will miss the next big rally. Conditions in China are tenuous and a rate hike is likely in September. Consequently, we won't see much of a rally off of this low.

I suspect that the market will chop around at the low-end of the range. Welcome to the summer doldrums.

If by chance we see a series of days with selling in the afternoon - beware. That will tell me that profit-taking/risk reduction is taking place. A pattern of higher opens and lower closes would be bearish especially if we close on the low.

The 200-day moving average doesn't mean much anymore. We cross it at will. Major support is at SPY $204.40 and that represents a 200-day uptrend line. If that is breached, it is meaningful.

I will be day trading. The market has no follow-through and I'm not expecting any surprises in the next week. I will let you know if I see a bearish pattern unfolding. As long as we close above the 200-day moving average, I will continue to day trade. Keep your overnight risk exposure small.

.

.

Daily Bulletin Continues...