Look For Choppy Trading At the Low End of the Range – FOMC Minutes Will Be Benign Wed

FREE WEBINAR WED. Click the link to register and I will show you a pattern I trade with incredible success.

Posted 12:30 PM ET - The market is probing for support this morning. Weakness in Asia spilled over and the S&P is down slightly.

China's market fell 6% overnight and the volatility continues. Flash PMI's will be posted Monday and any decline in economic activity will spook investors.

Until then, the market should chop around at the low end of the range. Option expiration should not have much of an impact, but we could see one volatile day as traders "square up".

The FOMC minutes will be benign tomorrow afternoon. The Fed did not show its hand when the statement was released and I don't believe there will be any surprises in the minutes.

Earnings season is winding down. Walmart missed and Home Depot exceeded.

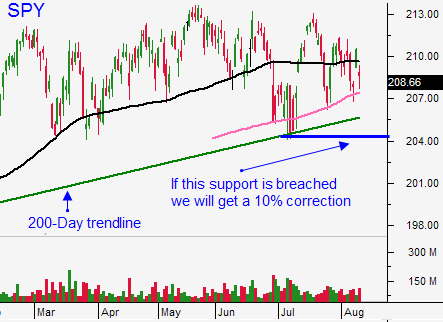

I will focus on day trading as long as the SPY stays above $207.60. Every little decline the last few days has presented a nice buying opportunity.

If I see a pattern of late day selling, I will consider buying puts as technical support levels fail ($207.60, $206.00 and $204.40).

Look for a quiet choppy week.

.

.

Daily Bulletin Continues...