Make Money Trading This Pattern – Webinar Tonight – Flash PMIs Fri Could Be A Problem

FREE WEBINAR WED. Click the link to register and I will show you a pattern I trade with incredible success.

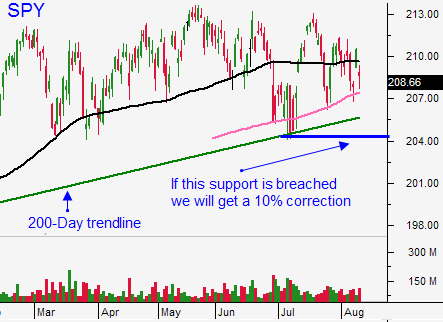

Posted 9:45 AM ET - Yesterday, the market probed for support and we did not get a bounce. That selling pressure continues this morning and the SPY is below the 100-day moving average.

Prices are so compressed that we cross major moving averages at will. If support levels at SPY $207.60, $206.00 and $204.40 fail, I will gradually buy puts. Asset Managers will not aggressively bid for stocks before the September FOMC meeting and our best chance for move is on the downside.

Concerns in China continue. Their market dropped 6% earlier this week and if not for government buying, it would have finished in negative territory today. Flash PMI's will be released Friday morning and this could be problematic. A weak number in China will spark selling and it could accelerate on option expiration.

If the market makes a new low after one hour of trading, I will buy puts. If this happens, we are likely to slip all day and close near the low. The 200-day moving average should hold today. I will use the 100-day moving average as my stop.

This market has been impossible to short and I will keep my size small. I will only add as technical support levels fail.

If the market chops around, I will focus on day trading. I've been very successful trading a specific pattern and I will show it to you tonight if you register for the webinar.

Keep your trades small.

.

.

Daily Bulletin Continues...