Market Pricing In A Sept Rate Hike – Conditions Will Be Good For Day Trading Until the FOMC

CLICK HERE TO SEE WHAT TRADERS SAID ABOUT MY CHAT ROOM

Posted 11:00 AM ET - This morning we learned that 170,000 new jobs were added in August. This might have appeared like a miss (220K expected), but June and July were revised upwards and there were seasonal adjustments. Overall, the number was fairly strong. It was certainly not weak enough to prevent the Fed from hiking on September 17th.

The market tanked on the news and the S&P 500 was down 30 points. From my perspective, the market was going to selloff either way. If the number was strong, traders would fear a rate hike in September. If the number was weak, economic growth would be questioned.

The market has been extremely volatile and 30 point S&P moves are common overnight. This is an impossible environment for overnight positions.

Some traders are tempted to sell options since implied volatilities are sky-high. I don't like that strategy ahead of a binary event that occurs before option expiration. The FOMC will meet on September 17 and option premiums will stay "rich".

This environment is ideal for day trading. Once the momentum is established, you ride it until it stalls. Prices tend to compress and then reverse.

If you are a swing trader, stay on the sidelines. If you are a day trader, always have a list of longs and shorts.

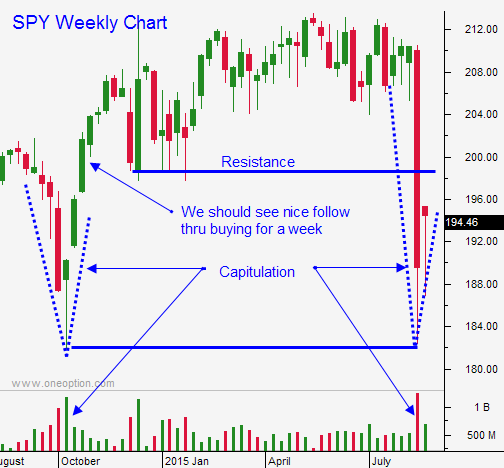

Traders are preparing for a rate hike in September. The ideal scenario would be a quarter-point move with a nasty decline down to SPY $182. If this scenario unfolds, we will have an excellent buying opportunity.

Unfortunately, I don't believe the Fed will hike and this will move the timetable back to March. Every month we will be dissecting every word in the statement and conditions will remain choppy. We will see a gradual move higher into year-end, but there will NOT be sustained moves that we can sink our teeth into. I hope I'm wrong, but the Fed has been very dovish for the last six years and I don't see that changing when global markets are declining.

The FOMC will be a week away when we return from holiday.

Have a great Labor Day.

.

.

Daily Bulletin Continues...