Market Is Ready For A Rate Hike – New All-Time High Likely In December

TAKE THE 1 WEEK FREE TRIAL FOR DAY TRADERS AND FOLLOW US IN THE CHAT ROOM

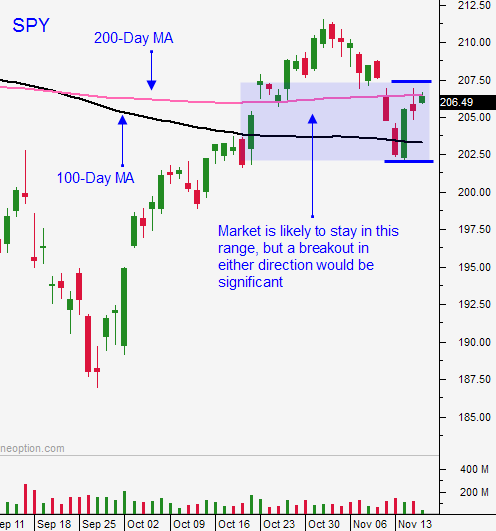

Posted 9:45 AM ET - Yesterday the FOMC minutes were released and the tone was hawkish. The market rallied above the 200-day moving average and momentum pushed us higher. I'm certain that many traders sold calls above SPY $207 on the notion that resistance would hold. They scrambled to cover and under allocated Asset Managers bought what they could. This added fuel to the fire. I'm confident that they still have stock to buy and we should see positive price action today and tomorrow.

We have new information. Prior to this move we did not know if the market was ready for a rate hike or if traders simply didn't believe that the Fed would raise rates in December. Now we know that a rate hike is priced in. Let's hope the Fed does not screw this up.

A strong market should not have an issue with a tiny quarter-point rate hike. This move will not have much of an impact on economic activity. The Fed said that if they act early, they can lower the trajectory. If the December rate hike is accompanied by the phrase "one and done", we could see a new all-time high.

The reaction to the jobs report last month suggested that the market was ready for lift-off. I expected a pullback for a few days and a rally. It did not happen on the timeframe I expected. The selling was heavy Thursday and Friday and we tested the major moving averages. We've seen a sharp reversal and we are back above the 200-day moving average. Now we could be set for that slingshot move I referenced 2 weeks ago.

Flash PMI's will be released next week, but they won't include China. I believe that the price action will generally be positive and Thanksgiving will suck the life out of the market. When we come back, the jobs report will be in focus. The number should be above 200,000 and it will cement a rate hike. Stocks should be able to shoulder the news and we will float up to the all-time high and stall until the FOMC on December 16.

Yesterday I outlined my game plan.

"Watch for resistance at the 200-day moving average today and watch for selling after the FOMC minutes. If by chance the reaction is positive, we could rally above the 200-day moving average and option expiration could fuel the move if the momentum is strong. I don't believe this scenario will unfold, but I will day trade it if it happens. I would welcome the rally because it would give us another support level to lean on.

I will be flat ahead of the announcement and then I will let the price action determine my strategy. There is not much news to drive the market so the FOMC minutes will be significant."

If I don't know what the markets going to do, I will tell you. I was flat going into the release and I bought calls as soon as were back above the 200-day moving average. We closed on the higher the day and I held them overnight. I will ride them another day and I plan to buy more today."

On Friday I will take profits and I will shift to a more neutral strategy. I will be selling out of the money bullish put spreads on stocks that are breaking out. We are above the 200-day moving average and I can lean on that support. I believe the trading activity will fall off next week and I want to take advantage of time decay.

After a big market run, I would expect sluggish price action this morning. When we don't retrace the bid will strengthen and the market will grind higher. Try to get long early in the day.

.

.

Daily Bulletin Continues...