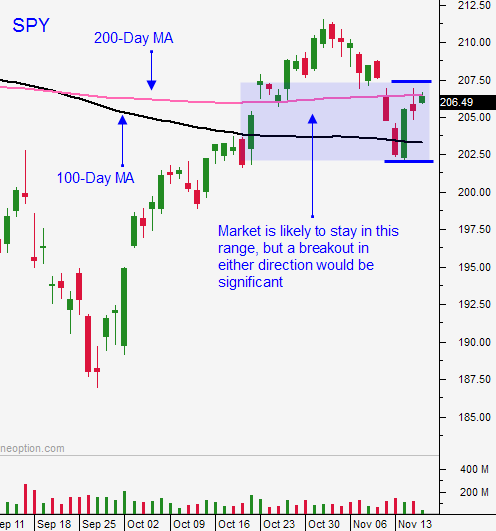

FOMC Minutes Will Move the Market – Use the 200-Day MA As Your Guide

Posted 9:50 AM ET - Yesterday, the market tried to rally above the 200-day moving average and it was turned back. Terrorism has dominated the news and the rally could not gain traction. Stocks will test that level again today.

The FOMC minutes will be released this afternoon and I believe the news could spark a round of selling. The Fed had the employment data ahead of the release and I believe their comments could be hawkish.

In the last week we've seen buying and selling on heavy volume. We will find equilibrium between the 100-day and 200-day moving averages and the range will compress as we head into a holiday shortened week.

After Thanksgiving, the jobs report (December 4th) will be in focus. A number above 200,000 will weigh on the market. This will almost guarantee a rate hike in December. Once the dust settles we will be in a holding pattern until the FOMC statement on December 16th.

There will be a couple of trading opportunities in the next few weeks, but they will pass quickly.

Economic conditions are sluggish and many traders believe that a rate hike is premature. Other traders believe that a tiny quarter-point rate hike should not impact economic activity and they welcome the move.

I will be day trading the next few weeks. I like using the one hour range as my guide. If the market is above the first hour high, I focus on bullish day trades. If the market is below the one hour low, I look for shorting opportunities. Once the momentum is established, it tends to continue the rest of the day.

From an option trading standpoint, you have to be a seller. The market will fall into a tight trading range and you need to capitalize on time decay. Sell out of the money bullish put spreads and sell out of the money bearish call spreads. These strategies will allow you to distance yourself from the action and you will be able to ride out some of the choppy moves in the next few weeks.

If we get a rate hike in December, the Fed will soften the blow with a "one and done" phrase. Provided that we pullback slightly ahead of the statement, we should see stocks move higher the remaining two weeks of the year. In aggregate, I don't believe we will go move much during the remainder of the year and we could find ourselves right at this level.

I won't be able to predict choppy little moves within a range so I will keep my trades small.

Day trade and look for opportunities to sell option premium.

Watch for resistance at the 200-day moving average today and watch for selling after the FOMC minutes. If by chance the reaction is positive, we could rally above the 200-day moving average and option expiration could fuel the move if the momentum is strong. I don't believe this scenario will unfold, but I will day trade it if it happens. I would welcome the rally because it would give us another support level to lean on.

I will be flat ahead of the announcement and then I will let the price action determine my strategy. There is not much news to drive the market so the FOMC minutes will be significant.

.

.

Daily Bulletin Continues...