Jobs Report Will Be Strong – Good News Is Good News

WE ARE MAKING A TON OF MONEY IN THE CHAT ROOM. TAKE THE 1 WEEK FREE TRIAL

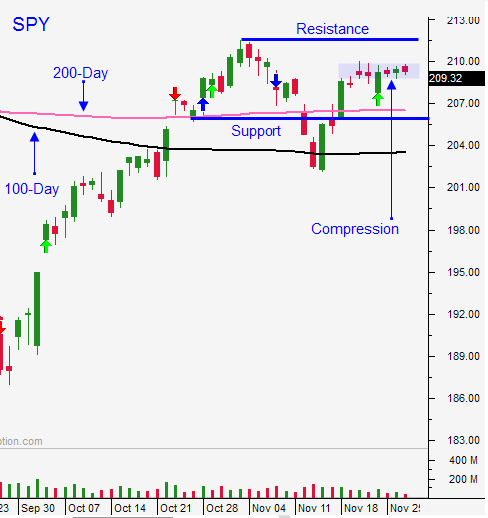

Posted 9:55 AM ET - The market continues to chop around. Up one day, down the next. We will continue to see this pattern until the FOMC statement in two weeks.

ADP came in strong and that bodes well for tomorrow's jobs report. We should see more than 200,000 new jobs in November and that will cement a rate hike.

Janet Yellen said that tightening will be gradual, but not to expect a “one and done” phrase in the FOMC statement. I believe that contributed to yesterday's decline.

This morning the ECB was less dovish than expected. Drahgi will not ease until he sees the impact from our rate hike and that is wise given the beat down in the Eurodollar. The S&P 500 was up 12 points before he started speaking and it fell into negative territory.

The California shootings also contributed to some of the selling yesterday. However, these terrorist acts rarely have a lasting market impact. Once the market breaks out of the first hour range, it tends to continue in that direction and the momentum builds.

In the next two weeks analysts will try to justify every wiggle and jiggle. Know that this price movement is all noise. Asset Managers are not going to place big bets until the FOMC statement.

This environment sets up well for premium selling. Bullish put spreads on strong stocks will take advantage of time decay. The market will stay above its 200-day moving average and we can lean on it. Sell puts below technical support and use that as your stop. Distance yourself from the action and let this noise play out.

I am day trading based on the first hour range. If we are below it, I am not day trading. I simply can't find any decent shorts. If we are in the one hour range, I will trade passively from the long side and I will look for horizontal breakouts. If the market is above the first hour range, the momentum is likely to continue. On these days, I am more aggressive with my longs. Tuesday was a great example.

Keep your size relatively small while we wait.

Given that the Fed is likely to hike, we need strong economic releases. ISM services will be posted after the open and they should be decent. Friday's jobs report should also be strong. A rate hike is already expected and strong economic data should not spook the market. Good news is good news.

We are likely to probe for support this morning. I believe this will set up an excellent buying opportunity later in the day. Use the day trading guidelines I provided and look for opportunities to sell bullish put spreads.

.

.

Daily Bulletin Continues...