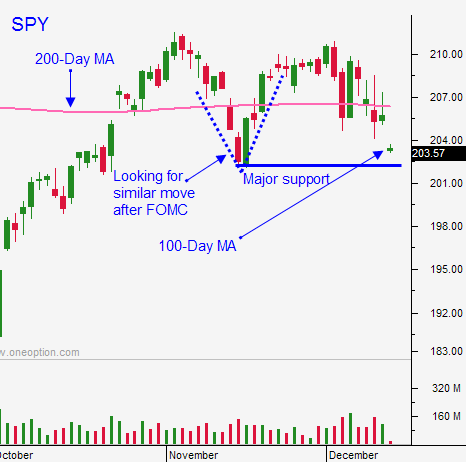

Market Drops To 100-Day MA – Watch For A Capitulation Low

Posted 9:30 AM ET - Be careful what you wish for. I was hoping that the S&P 500 would challenge the 100-day moving average before the FOMC and we are going to do that this morning. It is difficult to keep the faith when everything is crumbling. That is what trading is all about.

There wasn't much overnight news to justify this decline. Weak commodity prices are weighing on the market and traders are nervous about the rate hike. Asset Managers are pulling bids.

We've seen this price action a number of times this year before FOMC meetings. During the actual announcement, we see a massive rally. I believe we will see the same next week.

The market is ready for a rate hike and dovish rhetoric will calm nerves. If the Fed does not hike they will lose all credibility and the market will tank.

I do not suggest buying puts today. Support is close and the downside is limited. If the 100-day moving average is breached, we will test SPY $202. I will be looking for an air pocket and a sharp intraday reversal that never looks back. Follow-through buying will tell me that it's time to get long. Ideally, this pattern will present itself before the FOMC statement.

China will post industrial production and retail sales over the weekend. In line numbers will calm nerves. Flash PMI's (except for China) will be posted next week. Europe has been stable and this should also help.

It's very important to know that I am keeping my size small. If we get the deep drop I mentioned, I will increase my size. However, it will still be a third of what I was trading August through October.

This is a skittish low probability trading environment.

Seasonal strength should attract buyers once we swallow this bitter pill. I am not looking for a massive rally, just a nice rebound into year-end. Energy stocks have been pounded and they will no longer be a drag on the market.

As we enter 2016, I am fairly bearish. I've seen more selling in the last four months than I've seen in years.

I am sticking to day trading the next few days. I will let this wave of selling pass and I will look for buying at major support levels. My trading system finds stocks with relative strength. They will weather the storm and they will be ready to jump when the market stops going down. Any little bounce and they will take off. We've been using this tactic successfully all week.

The selling momentum has accelerated in the last 10 minutes. and it looks like we will breach the 100-day moving average on the open.

Hold onto your hat and see if we get that capitulation low today.

I might short some stocks intraday, but I will not hold any shorts overnight. I want to keep my focus on the long side. If you want market commentary throughout the day, take the one-week free trial and spend time in my chat room.

.

.

Daily Bulletin Continues...