Market Rally More Likely Than Decline – Buy Calls On A Capitulation Low

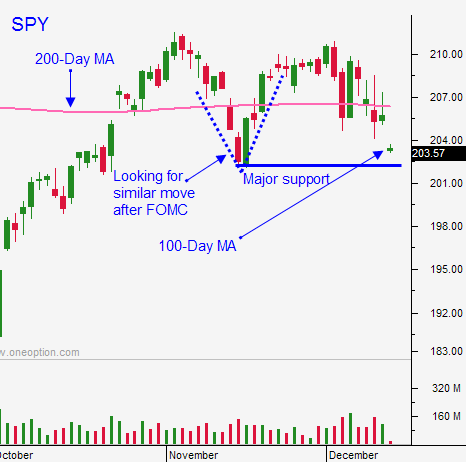

Posted 10:10 AM ET - Last week the market breached the major moving averages and horizontal support at SPY $202. Low oil prices and the prospect of higher interest rates weighed on credit markets. All eyes are on the FOMC this Wednesday and this is going to be a wild week.

China's industrial production and retail sales were better than expected. They no longer post a flash PMI number so this will be the last economic news of the year. Conditions are stabilizing and China will not be a concern for the next two weeks.

Oil prices continue to slip. However, they are close to forming a bottom and energy stocks will no longer be a drag on the market. Bad news is priced in and there are economic advantages to low oil prices.

A tiny quarter-point rate hike should not impact economic activity. The Fed will raise rates and dovish rhetoric will take the sting out of the move. Bearish sentiment is extremely high and central banks love to screw shorts. Option expiration is Friday and this gives them the perfect opportunity to spark a short squeeze.

Almost every FOMC meeting this year resulted in a rally and we should see one this week.

Seasonal strength will attract buyers. Stocks are still the best game in town with bond yields near historic lows. Corporate buybacks are at record levels and there is always an underlying bid to the market.

Credit concerns are on the rise. However, we don't have any bank defaults and we are not likely to see any in the next two weeks.

We are below major support levels and I'm expecting to see a capitulation low. Watch for an air pocket and an intraday reversal that never looks back. If I see this pattern, I will buy some January calls. I will keep my size relatively small ahead of the FOMC.

If the market rallies after the statement on Wednesday, I will buy more calls. If the reaction is negative, I will exit my calls and look for another opportunity to get long.

Even if we get a big market decline, I will not buy puts or sell calls. The selling is over-extended and the risk of a "bear trap" is high. If a longer-term bearish trend emerges, I will short when resistance at $202 is tested and it holds. In a bear market, the bottom falls out quickly and you need to take profits during the big declines. Snapback rallies in a bearish market are violent and once they run their course you can reload.

I have been day trading from the long side and I've been making great money the last week. I will continue using this tactic. When the market bounces, my stocks produce nice profits and I have a chance to make a killing if that strong reversal surfaces. This tactic also keeps me searching for bullish stocks and when we do get the reversal, I will know which calls to buy. Take the free trial and watch me make money trading against the market in the chat room.

I still feel the best trade will come on a rally, not a decline.

The market will probe for support this morning. Watch for a deep trough and an intraday reversal that never looks back. If you see it, buy January calls on strong stocks like ADBE. If the market drifts lower and it never ticks higher today, keep your powder dry.

Bearish sentiment is extremely high and pessimism is overblown. Do not buy put options. They are extremely expensive.

.

.

Daily Bulletin Continues...