Buy Puts When This Rally Stalls – Global Economic Conditions Are Slipping

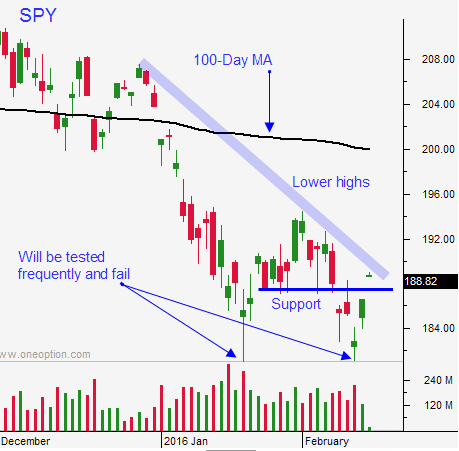

Posted 9:30 AM ET - Last week the market tested major support at $182 and buyers stepped in. We had a nice rally Friday and news over the weekend will push the SPY above resistance at $187.50 this morning. I don't trust these early rallies and I will be day trading from the short side once the momentum stalls.

On a longer-term basis, global economic conditions are deteriorating. Central banks are out of bullets and at best they can spark small short covering rallies like the one we are seeing this morning.

China's imports fell 11.2% and exports fell 18.8%. Commodity imports were down 14.5%. China's retail sales came in a touch better than expected at 11.2%.

The PBOC said it will defend the Yuan and that further devaluation is NOT inevitable. They will also make loans more available on a regional basis and this could ease credit concerns for the time being.

Japan's GDP fell 1.4% last quarter. The BOJ eased 2 weeks ago and interest rates are in negative territory. This surprise move barely moved the needle and a tiny little one-day rally was all it produced.

Russia and Saudi Arabia agreed to a production freeze. Many analysts were hoping for a production cut. Oil prices are slightly higher this morning, but any rally will be short-lived. There are too many global producers and OPEC no longer controls prices. Demand is likely to decline as global economic activity contracts.

The FOMC minutes will be released tomorrow afternoon. They won't contain any new information. Janet Yellen was grilled last week when she testified before Congress. Given the recent domestic economic releases (ISM services and the Unemployment Report), I don't believe the Fed will hike before June.

This economic cycle will run its own course. During the process, credit issues could arise. If this happens, we could see very heavy selling this year.

Let's see if this rally can gain traction. The higher we go, the more interested I am in selling call credit spreads (bearish call spreads). If the rally stalls and we fall back below $187.50, I will consider buying put options.

I believe the market will spend more and more time at the $182 level. Eventually support will fail.

When the SPY fell from $205 to $182 last August, buyers immediately stepped in. They saw this as a fantastic buying opportunity. Now that we are spending more time at $182l, buyers are not as interested. They sense that they will have plenty of time to scoop stocks at this level and perhaps at lower levels.

I will day trade from the short side in the first couple of hours once the rally stalls. If we fall below $187.50 I will stick with the short side. If the market finds support and we stay above $187.50, I will day trade from the long side.

From my perspective, the higher we go the better the shorting opportunity. I would love to see us challenge SPY $200, but that is not likely to happen for a long time.

.

.

Daily Bulletin Continues...