Market Rally Will Set-up A Great Short – Let It Run and Don’t Be Early

1 WEEK FREE TRIAL - SEE WHAT WE ARE TRADING IN THE CHAT ROOM

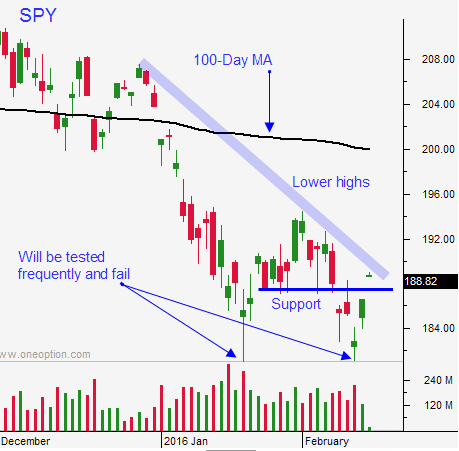

Posted 9:30 AM ET - Yesterday the market rallied above key support at SPY $187.50 and that level held throughout the day. We managed to string a few nice days together and the futures are up pre-open. The higher we go, the better the shorting opportunity. We don't want to be early, so let's let it run.

When the market held support yesterday, I sold out of the money bullish put spreads in February (NFLX, CMG, SKX, UPS, CREE…). This option trading strategy takes advantage of time decay and we are only three days away from expiration. A positive open will help those positions today.

From a day trading standpoint, we have to be careful on the open when the market gaps higher. Many stocks look like they want to run, but they quickly fall back. I bought NFLX and RARE yesterday near the open and they never recovered. I like both stocks on a longer-term basis so I held them overnight. I will get a chance to exit this morning and I will probably make money on the trades.

The point I'm trying to make is that you need to use extra caution trading from the long side this morning. Let the early rally run its course and wait for a pullback. We always get one and when the market retraces you'll be able to spot relative strength. These are the stocks that want to move higher. They hold their bid well when the market pulls back and you can buy them once the market finds support.

If the market barely pulls back and we continue to grind higher, I will trade from the long side. If the market drifts lower and the selling is sustained, I will trade from the short side. Use the first hour range as your guide. If we are above the high, favor the long side. If we are below the low, favor the short side.

SPY $187.50 is support and I will maintain my bullish put spreads as long as we stay above it.

The PBOC and BOJ have been easing and the bid has temporarily been restored. Know that this is just a bounce.

Global economic conditions are deteriorating and central banks are out of bullets. They've done all they can and this recession will run its course naturally. The longer it lasts, the greater the chances for a credit default. I don't believe we will see one for many months, but I am constantly on guard.

As long as there aren't any credit defaults, the market will take two steps down and one step back. The decline will be fairly orderly and we will see a series of lower highs. If a credit default surfaces, the price action will be four steps down and one step back.

In the last six months I've seen more selling that I've seen in years. Markets have artificially been supported by central banks and that support is crumbling. Know that the long term trend is down and that this is simply a bounce.

The higher we go, the better the shorting opportunity. Don't be early.

Let this rally unfold and day trade it. Take your lead today from the first hour range.

.

.

Daily Bulletin Continues...