Let the Market Run – Bearish Call Spreads Will Set-up Next Week

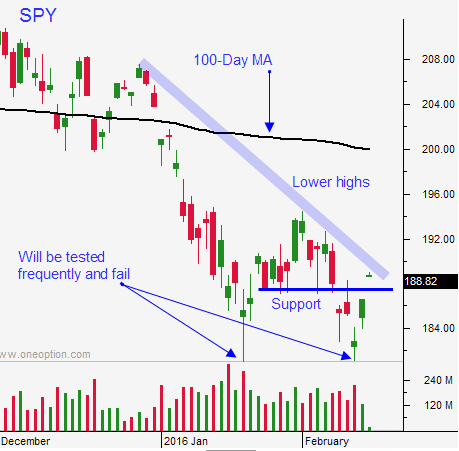

Posted 9:50 AM ET - Yesterday the market continued to bounce. From the low on Friday the S&P 500 has rallied 100 points. It has come a long way in a short period of time and resistance at SPY $193.50 should hold.

Monetary easing by the PBOC and BOJ has sparked buying. These actions will not stimulate economic growth and this rally is nothing more than a bounce. The higher we go, the better the shorting opportunity.

Domestic economic conditions have also started to falter. That will prevent the Fed from hiking and the dollar has retreated. The long dollar trade was very crowded and weak hands are being flushed out. A declining dollar is good for exports and commodities.

Cyclical stocks are grossly oversold and they are bouncing. We have been day trading these stocks in the chat room and the short covering rally has presented excellent opportunities. These moves will stall so we are not carrying any overnight positions in cyclical stocks.

China's commodity imports were down 14.5% - basic materials will remain weak. Global economic conditions are slipping and central banks are out of bullets.

We have been selling out of the money bullish put spreads. This options trading strategy takes advantage of time decay and we can distance ourselves from the action. It also takes advantage of high option implied volatilities. These trades are all safely out of harm's way with two days to go.

As the market grinds higher, bearish call spreads will set up. I will be watching basic material stocks and heavy equipment manufacturers. They will run out of steam soon.

It is important to let this rally run. We've seen some buying and we need to let it run its course. By the middle of next week, the momentum should run out of steam.

Resistance at $193.50 should hold this week.

Use the one hour range as your guide for day trading. By now you should know the routine. Short if we are below the first hour low and buy if we are above the first hour high.

Many stocks are grossly oversold and they will play "catch-up". The market simply needs to hold this level for them to move higher. Stocks that are grinding higher off of a solid base are your best prospects once they break through horizontal resistance. They won't fight a negative tape, but they will rally if the market is flat. In the event that we get a rally, they will take off.

Support will be tested early and the market should be able to finish in positive territory today.

.

.

Daily Bulletin Continues...