Market Will Tread Water This Week – Look For Tight Ranges – Trim Your Size

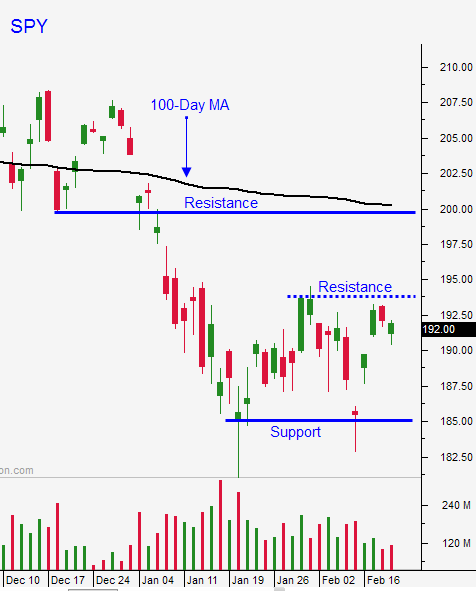

Posted 9:30 AM ET - Last week the market rallied 100 S&P points off of the low. Prices got a little stretched towards the end of the week and we retraced slightly into options expiration. This morning we will be challenging the highs from last week and horizontal resistance at SPY $195.

The rally this morning is a bit puzzling. Flash PMI's missed expectations. Europe was okay, but Japan missed by a large margin. China no longer publishes a flash PMI and we will have to wait for the official number next week.

The economic news is light and there is nothing to drive the action. A week from Friday we will get the jobs report. If we hit 180K+ it will be a non-event. On the other hand, anything in the 150K range could be problematic.

The FOMC will release its statement on March 16th. Given weak market conditions and global economic concerns, they are not likely to hike before June.

Earnings season is tapering off and the news on every front is light.

The PBOC and BOJ have been printing like mad and that has sparked some buying. Unfortunately, central banks are out of bullets and their actions are not stimulating economic growth. The global economic downturn will have to run its course naturally.

In the first six weeks of the year, the selling pressure has been heavy. I am bearish on and intermediate basis and I want the SPY to challenge $200. That is the 100-day moving average and if we get there, we will have an excellent shorting opportunity. The higher we go, the better our entry point for put purchases.

I don't want to short too early so I will wait for signs of exhaustion. I have been selling out of the money bullish put spreads. This options trading strategy allows me to distance myself from the action and take advantage of time decay. Many bullish put spreads expired Friday and this strategy produced nice returns in February.

If we get above SPY $195 I will start looking for bearish call spreads. Basic materials and cyclicals should start to hit resistance soon.

I don't like trading up gaps. All stocks rally on these moves and it is tough to distinguish the "real McCoy's". Be patient and wait for a market pullback. The strongest stocks will hold their bid and they will be ready to jump when the market finds support.

I might try a few shorts near the open once this gap higher hits resistance. We should see that resistance early since we are only a few points away from $195. When the market probes for support, these shorts should perform well. If I can't find any good-looking shorts, I will wait patiently for trades to set up on the long side.

Look for tight ranges and an upward bias this week. We are in a news vacuum so trim your size.

.

.

Daily Bulletin Continues...