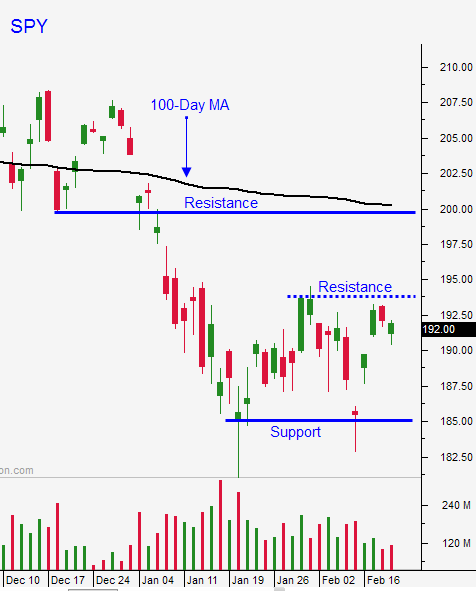

Market At Critical Juncture – SPY $200 Would Set-up A Great Short – Be Patient

1 WEEK FREE TRIAL - SEE WHAT WE ARE TRADING IN THE CHAT ROOM

Posted 9:30 AM ET - After a slow start, the market was able to grind higher yesterday and it finished just below resistance at SPY $195. This was a better showing than I expected and we are seeing follow-through this morning. If the market can hold $195 today, it has a chance to test $200 next week.

Tuesday we will get China's official PMI and that will be a very important number. If it is better than feared, the market will rally on the news. Initial jobless claims have been decent and the jobs reports should improve from the 150K level we saw last month. This would also be market friendly.

Durable goods orders were slightly better than expected yesterday and GDP came in above expectations this morning. It's hard to imagine that 1% growth can excite anyone.

We've seen the danger of shorting this rally too early. Anyone who bought puts this week is taking a beating. Bears needed to wait for follow through selling Wednesday morning and we did not get it.

I've been hoping for a rally to the $200 level and we could get there. This is major horizontal resistance and it is the 100-day moving average.

The market is at a critical juncture today and we need to see how this plays out. I am short some out of the money bullish put spreads and they are in fine shape. This options trading strategy allows me to distance myself from the action and take advantage of time decay. I will not be selling any new credit spreads on either side of the market. We need to see how the numbers come out next week and how the market reacts.

Oil is moving higher on the notion that major producers will agree not to increase output. There are too many producers and there will be cheating. Oil fell more than it should've and it will probably bounce higher than it should. On a long-term basis, oil prices will remain suppressed.

The same can be said for the market. Fear of a potential credit crisis sparked panic selling and stocks fell more than they should have in January. There have not been any credit defaults and buyers are gradually increasing risk.

Global economic conditions are soft and central banks are out of bullets. Activity will continue to wane and the bleeding can’t be stopped.

We need to let this bounce run its course. When it stalls, an excellent shorting opportunity will present itself.

We've had great success day trading in the chat room and we will stick with what is working. I will favor the short side during the first hour of trading. It will be easy to spot weak stocks and these opening rallies have a tendency to falter. I will look for stocks that gap down and bounce with the market. When the bounce stalls I will get short. I will be trading against a strong market so I will set targets – hit and run.

If SPY $195 holds, I will shift to the long side. After an hour it will be easier to separate the really strong stocks from the ones that just followed the market.

Use the first hour range as your guide. If we get above the high, favor the long side. If we are below the low, favor the short side.

Once the market closes above $195, we can use that support as our entry point for shorts when the SPY falls back below it.

Stay flexible.

.

.

Daily Bulletin Continues...