ECB Cut Was A Great Short – Still Too Early To Buy – Be Patient and Trim Size

Posted 9:30 AM - Yesterday the ECB fired its bazooka and the market rallied above major resistance. The news was expected and traders faded the rally. In my comments I mentioned that this was a "sell the news event" and we made a killing shorting the S&P futures and shorting stocks. Once the selling reached a climax, we covered our positions. Thursday will probably be one of my top 20 trading days this year.

Central bank easing is not a bearish event, but this news was propping up the market. Bullish speculators rushed in and the door was slammed in their face.

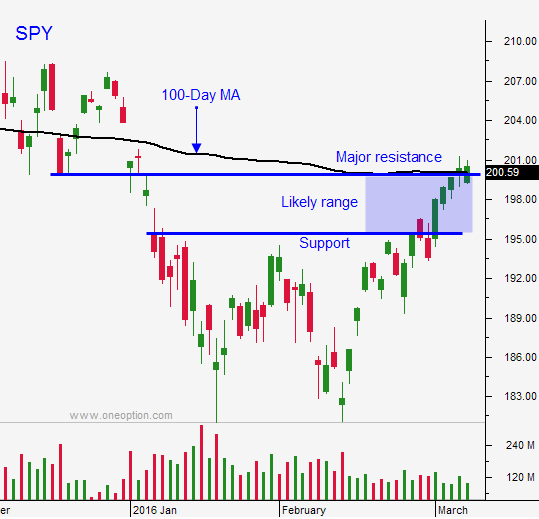

The market is challenging the high from yesterday in pre-open trading. The longer the SPY trades at this level and the more times it tests resistance at $200, the more likely it is to break through.

We can't get too excited yet. The 200-day moving average is at $202 and I'm not expecting a runaway rally.

This is a critical juncture and it is important to trim your size and your activity. The market still doesn't know which side of $200 it wants to be on. The market could go either way and the probability of success for overnight positions is low.

I will use SPY $200 as my guide for swing trades. If we fall below it, I will sell out of the money bearish call spreads today. If the market rallies above $200 I will hold off on selling bullish put spreads. I want to see the market hold this level for at least a week and I don't want to be short puts ahead of the FOMC next Wednesday.

The calendar is light and there are not many news releases scheduled. The Fed is not likely to raise rates this year, but there rhetoric could turn a little more hawkish after last months "hot" jobs report.

I am short a few stocks and I am long April puts on a handful of weak stocks. If $200 holds today, I will buy back some of my short stock positions. I don't mind owning puts. My risk is limited and these positions provide a small hedge when I day trade from the long side. The chance of an overnight decline is possible given the heavy selling we've seen this year. My overnight positions are bearish, but my exposure is very small.

The rally this morning seems legitimate. The downside was tested yesterday and buyers stepped in. We are seeing follow-through this morning and I'm expecting a bullish day.

My day trades will focus on the laggards that are breaking through horizontal resistance. Tech has not participated in this rally and these stocks have room to run. I am expecting some rotation out of cyclicals and into tech.

We are bumping up against major resistance levels and the upside is fairly limited. Be patient and wait for good entry points.

.

.

Daily Bulletin Continues...