Final Leg of the Rally Will Be Sparked By Tech – Watch For Exhaustion

Posted 9:40 AM ET - The last two days the market has opened on its high and closed on its low. That is a bearish pattern, but I won't read too much into it. Bullish speculators were flushed out of the market and this is just a normal round of consolidation.

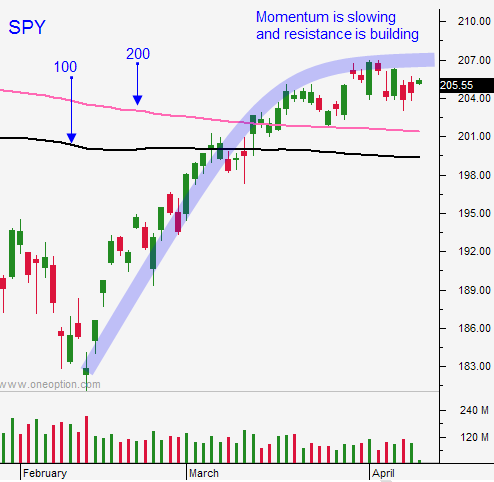

The SPY will open above resistance at $205 this morning and we can lean on that level. If the market stays above it, I will focus on bullish day trades. If the market is below that level, I will focus on bearish day trades.

The daily price action is very "noisy". This is ideal for day trading, but it is not good for swing trading. The bid should strengthen ahead of mega-cap tech stocks and we should see a rotation into that sector. Consequently, I will favor the upside and I will focus on tech.

Alcoa will post results after the close today and banks (JPM, BAC and WFC) will post later in the week. These results won't have much of a market influence. Next week earnings will crank up and that will present many day trading opportunities.

China will post its trade balance on Wednesday and it will post IP/GDP/retail sales on Friday. These will be important numbers. Conditions have temporarily stabilized in China and the reaction should be market friendly.

My longer-term forecast is bearish and my short-term forecast is bullish. Because these forecasts conflict, I won't be swing trading. I want to watch this final push higher and I want to capture it through my day trades. As we approach major resistance, I will be watching for signs of exhaustion. Ideally, this last leg higher will quickly run out of steam. I believe that Apple's earnings will mark the high point.

We have to wait for this last leg of the rally and the reversal. Otherwise, we risk being on the wrong side of a blow-off top. I plan to wait for technical breakdowns before I get short.

I do see some dark clouds on the horizon in June.

Be patient and focus on day trades. Use SPY $205 as your guide today. You can also use the first hour range as your guide.

In this noisy environment, I also like fading overnight gaps where the S&P has moved more than 10 points. I can usually pick off a couple of good day trades in the first 30 minutes using this strategy. After that, I use the first hour range as my guide.

There is a very specific pattern I use for day trading. Take the free trial and you will see me teach it in the chat room.

The bid should strengthen this week and we should see a rotation into tech.

.

.

Daily Bulletin Continues...